Activity

-

NAFA Administrator posted an articleAircraft Lease Agreements, Explained see more

NAFA member, H. Lee Rohde, III, President and CEO of Essex Aviation, shares what you need to know about aircraft lease agreements.

Aircraft leasing is a popular private aviation option for corporate entities and private individuals alike. In order to lease an aircraft, a lessee and lessor must sign an aircraft lease agreement, which defines the terms of the lease, such as who is responsible for operating and maintaining the aircraft, the length of the lease and so on.

For this article, we’ve enlisted the help of David M. Hernandez and Edward K. Gross of Vedder Price, an international business-focused law firm, to explain what aircraft lease agreements are and how they differ depending upon which leasing structure you choose.

Table of Contents

- The Two Most Common Types of Lease Structure

- The Different Types of Aircraft Lease Agreements

- Components of a Standard Aircraft Lease Agreement

- Drafting an Aircraft Lease Agreement

- Key Aircraft Lease Agreement Considerations

- Renegotiating an Aircraft Lease Agreement

- What to Know Before You Sign an Aircraft Lease Agreement

The Two Most Common Types of Lease Structure

There are two primary types of aircraft lease structure:

Traditional Ownership Structure Lease

Also known as an operating lease, the owner (either a business or an individual) acquires an aircraft and sets that aircraft up as its own legal entity, typically a limited liability company (LLC). The LLC will often enter into a lease agreement with the actual intended operator of the aircraft — usually the original buyer — so that they can use the aircraft. This prevents the LLC from being considered a prohibited flight department company. From there, the LLC — which legally owns the aircraft — may also enter into an aircraft management agreement with a management company. The management company is responsible for managing the aircraft on behalf of the owner, as well as operating the aircraft for third-party commercial charters. Some owners decide not to hire a management company and instead elect to hire their own pilots and maintenance personnel.There are a number of reasons why an aircraft owner might create a traditional ownership leasing structure, including for tax purposes, for privacy or to comply with Federal Aviation Administration (FAA) regulations. Many owners choose to take advantage of what is referred to as “sale for resale” state tax exemptions; this exemption enables the owner to spread sales tax across lease payments, rather than pay in full at closing. Some owners would prefer that their company name not be listed on the FAA registry and would, therefore, rather use an LLC as the registered owner of the aircraft.

Finally, the FAA prohibits entities from charging for the use of the aircraft and prohibits single member entities from owning and operating an aircraft; this is commonly referred to as the “flight department company trap.” As a result, some companies will set up an LLC as a leasing company and lease the aircraft to the actual operator.

Financing Lease

A financing lease is essentially an acquisition financing product and is an alternative to a secured loan. For the sake of simplifying things, you can think of lease financing as being similar to loan financing.In this arrangement, a financial institution will take ownership of the aircraft and enter into a lease agreement with a business or individual. This is essentially an acquisition structure that doesn’t require the actual purchase by the lessee of a plane, meaning the lessee doesn’t have to carry the aircraft on its balance sheet.

We refer to these acquisition financing transactions as “leases” for tax, accounting and commercial law/bankruptcy purposes. The lessor assumes all of the market value risks and benefits associated with ownership, especially regarding the value of the aircraft after lease expiration, and it allocates the “net” lease responsibilities (discussed below) to the lessee under the lease terms.

In the past, banks were typically the lessors in these financings, however, the number of banks that offer true (tax) leases has significantly diminished since the 2008 recession. Those interested in pursuing a financing lease structure are more likely to find opportunities working with an equity investor.

The Different Types of Aircraft Lease Agreement

The terms of an aircraft lease agreement changes depending on which leasing structure you choose to pursue.

Traditional Ownership Structure Lease

A typical traditional leasing structure often involves related parties. However, there are situations in which a traditional leasing structure would involve unrelated parties, in which case the lessee would be required to obtain pilot management services from an unrelated entity. It’s important to note that lessors cannot provide the aircraft and a pilot in a traditional ownership structure lease because that is considered a “wet lease” and generally requires an FAA Air Carrier certificate. The use of a time sharing agreement, under the Federal Aviation Regulations (FAR) Part 91.501, is a limited exception to this rule.Financing Lease

As mentioned, a financing lease is an acquisition financing product, so it is appropriate to compare it to a purchase money loan. Similar to a secured loan, the lessor finances the lessee’s prospective acquisition, however, the lessor advances 100% of the purchase price and the lessee’s payments are reduced to reflect the lessor’s tax and residual value assumptions; the lessee typically has flexibility to purchase the aircraft upon lease expiration or, perhaps, to extend the lease term.Put simply, the aircraft lease agreement for a financing lease is similar to a loan agreement; so long as the lessee pays installments and materially performs any other obligations under the lease, the lessor won’t interrupt the lessee’s use and operation of the aircraft during the lease term. The key difference between a financing lease and a secured loan is that the lessor assumes on the market value risk at lease expiration.

Components of a Standard Aircraft Lease Agreement

Let’s take a closer look at the basic components that an aircraft lease agreement structure should include, including general terms, starting with a traditional ownership lease.

Traditional Ownership Structure Lease

It’s uncommon for a bank or lender to be involved in a traditional leasing structure unless the situation were to call for both a traditional ownership lease and a financing lease. In a traditional leasing structure, FAA regulations require both the lessor and the lessee to obtain pilot management services from an independent third party. A lease without the provision of pilot services is considered a “dry lease,” whereas a lease with an aircraft and pilot is considered a “wet lease” and requires FAA certification. The vast majority of traditional ownership leases that people enter into are dry leases.Those interested in a traditional leasing structure should be aware that the FAA takes dry lease abuses very seriously and has aggressively pursued enforcement action against entities entering into fraudulent dry leases. Any entity that requires the lessee to use a specific set of pilots when leasing the aircraft is a de facto wet lease, and therefore requires an air carrier operating certificate; this ultimately subjects the lessor to less risk of enforcement action and civil penalties.

As far as general terms are concerned, any aircraft lease agreement for a traditional leasing structure should clearly specify which entity has operational control, performs maintenance, provides insurances and is generally responsible for the care of the aircraft while it is in the lessee’s possession. The lease agreement should also address all relevant aspects of the aircraft’s care and operation, including default provisions, choice of law, permitted use, return provisions and maximum hours of operation. Additionally, the lessor should reserve the right to inspect the aircraft if it is leased to unrelated entities.

Financing Lease

With a financing lease, the structure of the aircraft lease agreement will take into account whether the lessor is going to lease finance a new or pre-owned aircraft.If the lessor is lease financing a new aircraft, the lessee must assign its right to purchase the aircraft from the original equipment manufacturer (OEM) and, in some cases, to make progress payments due under the purchase agreement. If the lessor chooses to finance these progress payments, it will pay the balance of the purchase price to the OEM upon delivery, take ownership of the aircraft title and lease the aircraft to the lessee.

If the lessor is lease financing a pre-owned aircraft, the purchasing process is essentially the same, except for the fact that it is generally less time and cost-efficient than purchasing from the OEM, and the lessor doesn’t finance pre-delivery payments. If the transaction is a refinancing, it will be structured as a sale and leaseback, pursuant to which the lessor purchases the aircraft from and leases it back the lessee. This would necessitate an aircraft purchase and leaseback agreement.

In any case, once the purchase is complete, the lessee accepts the aircraft under the lease for the negotiated rent, term and certain lease expiry options. In some cases, the lessor might require additional support from the lessor in the form of a guarantee, deposit or other non-aircraft collateral.

The essential promise the lessee makes is that, upon acceptance, the lessee cannot cancel the lease and is obligated to pay the rents and other amounts listed under the lease come “hell or high water.”

These leases are typically “net” leases, meaning that the lessee agrees to pay all costs associated with owning, operating, maintaining, servicing, insuring and registering the aircraft, as well as all related taxes. Essentially, the lessee bears all risks associated with ownership, other than decline in the market value of the aircraft. The aircraft lease agreement will include a number of requirements and restrictions to ensure the safe operation and condition of the aircraft. By way of example, the lessee will be required to indemnify the lessor against liability claims, state taxes and loss of lessor’s anticipated tax benefits.

Although the lease is typically non-cancellable by the lessee, should the aircraft suffer a casualty, the lessee is required to pay the lessor the agreed value of the aircraft, determined at lease inception. Aside from a casualty, some financing leases might also permit the lessee to terminate the lease and purchase the aircraft from the lessor or otherwise make the lessor whole.

Most bank lessors are “credit” lenders, so the lease is likely to include credit covenants, cross-defaults and reporting requirements similar to what might be included in a credit facility agreement. At lease expiration, the lessee must either return the aircraft according to certain conditions set out in the lease, purchase the aircraft for (at least) fair market value or renew the term for (at least) fair market rental value.

Drafting an Aircraft Lease Agreement

The process of drafting an aircraft lease agreement is as follows:

Traditional Ownership Structure Lease

The most important aspects of drafting and negotiating a lease are understanding the goals and expectations of the parties involved and knowing which parties will be responsible for the care, maintenance and insurance of the aircraft. There should be no confusion as to:- Who will perform maintenance

- Who will be responsible for payment of maintenance service plans

- How the aircraft will be returned

- What the termination provisions are

- What notice is required

Every aspect of the use, operation and return of the aircraft should be addressed. The aircraft lease agreement should also address what happens in the event of any non-compliance or default, particularly in the case of unrelated parties.

Financing Lease

The credit approval process for a financing lease starts with the lessor conducting due diligence regarding the lessee/guarantor and the aircraft in question. From there, the lessor and lessee will create a term sheet, with the lessor covering financing terms, requirements of the lessor’s credit committee and so on. The lessor will then provide lease documents reflecting what was proposed in the term sheet, with all important details and/or agreed adjustments to the proposed terms.Next, the lessor and lessee will incorporate various terms reflecting the lessee’s ownership structure and operational expectations into the lease documents. Deliverables are then collected, and closing deliverables and action items are attended to. Assuming all concerned parties are satisfied, the lessor pays the purchase price to the OEM or seller, and the lessee accepts the aircraft under the lease agreement.

—

An important note: Given the significant investment of private aircraft and the potential for FAA, IRS and insurance violations, it’s in your best interest to retain a team of knowledgeable professionals to help you navigate this complex process. Regardless which leasing structure you choose, your team should include:

- An experienced business aircraft finance attorney

- A private aviation consultant

- A broker

- An OEM or other seller

- An insurance broker

- A management company or charter operator

- A maintenance program provider

- An aviation experienced accountant or tax advisor

- An FAA registration counsel and/or title company

Key Aircraft Lease Agreement Considerations

A few things to keep in mind before entering into an aircraft lease agreement:

Traditional Ownership Structure Lease

- The primary consideration is using the aircraft to its maximum operational capability consistent with the client’s wishes without violating any FAA or IRS regulations and insurance provisions. This requires full knowledge of exactly what each party wants to do with the aircraft within the limitations of those regulations and provisions.

- In accordance with the previous consideration, it’s imperative to understand the applicable FAA, IRS and insurance requirements to ensure that owners are able to operate the aircraft as they need. It’s best practice to discuss operational considerations with the management company.

- If the aircraft being leased under a traditional lease is being financed, all usage and other terms must be approved by, and subject to the rights of, the financing party; this is known as “consent.”

Financing Lease

- The terms and pricing, including rent, will be driven by the aircraft’s value, operational and maintenance expectations, the creditworthiness of the lessee and any customer relationship with the lessee.

- Some lessors — banks, in particular — are more conservative as to whom they’ll provide lease financing. Other lessors, especially equity investors, are asset financiers and are therefore less risk-averse; that said, that risk acceptance will be reflected in their pricing.

- Experienced and sophisticated lessors and lessees will have sorted out most of what they deem essential in the term sheet in order to avoid unnecessary investments of the time and legal costs required to put together a transaction that isn’t a good fit for either party.

- It’s important that lessees take a thorough and thoughtful approach not only to the proposed economics of the transaction, but also to purchase, operation, management, regulatory and tax considerations.

- Lessees must fully disclose all information that might be pertinent to the lessor’s willingness to lease the aircraft pursuant to what’s been proposed in the term sheet.

- The financing proposed in the term sheet must be practical and likely to be approved by the lessor’s credit committee well before the scheduled closing.

Renegotiating an Aircraft Lease Agreement

There are some instances in which it might make sense for a lessee to renegotiate or otherwise restructure an existing aircraft lease.

Traditional Ownership Structure Lease

Whether the parties involved want to renegotiate the lease depends entirely on their relevant and respective needs and whether there are issues that require renegotiation. Given that related party leases are typically handled internally, there are rarely any issues. However, an unrelated party lease could involve a wide variety of issues, including payment issues, operational issues or default provisions. Therefore, it’s imperative that all leases address how to make modification amendments and define applicable resolution provisions.Lessees are advised to be wary of any entity attempting to offer a lease as a viable alternative to a charter arrangement. The FAA is severely cracking down on such corrupt operations and has pursued multiple enforcement actions over the past two years.

The most important thing here is that all parties understand the terms and conditions of the lease. It’s inadvisable to sign a lease and worry whether you can comply with the terms after the fact. The lessee should always know exactly what they are responsible for under the lease and what the termination and default provisions are.

Financing Lease

Financing lease pricing is based on interest rates and market values. If there is a significant change in either or both, or if the lessee’s needs have changed and they intend to trade up through another lease with the same lessor, the lessee may be able to restructure the lease.Non-bank lessors are likely to be receptive to restructuring requests. Banks that offer leasing products are more likely to be receptive toward restructuring if the lessee is a desirable customer or if they intend to extend the lease at a time when the actual aircraft value is likely to be less than the assumed value at lease inception.

It’s important that both parties remain aware as to when it might be mutually beneficial to renegotiate or restructure the terms of the lease.

What to Know Before You Sign an Aircraft Lease Agreement

In order to expediently close a deal, it’s critical that lessees fully disclose expectations and other relevant information and be responsive to the lessor. In the case of a financing lease, having an existing banking relationship with the lessor could streamline the approval process and result in friendlier economic terms.

Lease financing for a desirable customer can be competitive; in such situations, lessees should prioritize the reliability of the financing provider over proposed financing rates and costs. To that end, lessees should place more weight on a lessor’s ability to close a transaction in a timely manner and their documentation or closing requirements than on whether they offer favorable economic terms.

Finally, in order to achieve all of their goals related to acquiring, financing and operating a new or pre-owned aircraft, lessees should retain the services of industry professionals with relevant experience and favorably recognized market reputations. This includes retaining legal counsel from a firm such as Vedder Price and advisory services from a private aviation consulting firm such as Essex Aviation.

This article was originally published by Essex Aviation.

-

NAFA Administrator posted an articleUsed Aircraft Maintenance Analysis – July 2020 see more

NAFA member, Tony Kioussis, President of Asset Insight, shares Asset Insight’s July 2020 market analysis.

Asset Insight's Juluy 31, 2020 market analysis revealed a 1.2% inventory decrease to the tracked business aircraft fleet – the first monthly reduction since January – along with an Ask Price decrease of 1.5%. Which models were impacted the most?

As July ended, Asset Insight’s tracked fleet of 134 fixed-wing business aircraft, and 2,331 aircraft listed for sale equated to a 1.2% inventory fleet decrease compared to June, and a year-to-date (YTD) increase of 6.8%.

The tracked fleet’s Quality Rating dipped a bit from June’s 12-month best figure, and the latest ‘for sale’ fleet mix increased the anticipated cost for upcoming maintenance events close to the 12-month high (worst) figure. However, July’s 5.293 Quality Rating kept the inventory within the ‘Excellent’ range on Asset Insight’s scale of -2.5 to 10.

July’s Aircraft Value Trends

Average Ask Price decreased 1.5% in July, leading to a 5.0% value decline since the start of 2020. By aircraft group, the figures were as follows:

- Large Jets: This group fueled the loss with a reduction of 2.4%, and a total value loss during 2020 of 11.8%.

- Medium Jets: Ask Prices increased 1.5% during July but were still down 3.7% YTD.

- Small Jets: The group posted a 12-month high figure through a 0.3% gain in value and is now up 9.2% for the year.

- Turboprops: Ask Prices gained 2.8% but are still off by 2.4% during 2020.

July’s Fleet for Sale Trends

The tracked fleet’s total number of aircraft listed for sale decreased 1.2% in July (29 units), reflecting a YTD inventory increase equating to 6.8% (149 units).

- Large Jet Inventory: Decreased slightly by 0.4% (two units), but remains up 14.8% (64 units) YTD.

- Medium Jet Inventory: Availability was down a substantial 2.7% (18 units) for July, bringing the YTD increase down to a single unit (0.2%).

- Small Jet Inventory: Decreased 2.6% (18 units) in July but was still up 6.4% YTD (41 units).

- Turboprop Inventory: The only group to post an increase, Turboprops were up 1.2% (nine units) for the month, and inventory has now grown 9.6% (43 units) YTD.

July’s Maintenance Exposure Trends

Maintenance Exposure (an aircraft’s accumulated/embedded maintenance expense) increased (deteriorated) 3.1% in July to $1.419m, signaling upcoming maintenance for the latest fleet mix would be close to the 12-month high (worst) figure. The last time our tracked fleet posted a higher (worse) Maintenance Exposure figure was in October 2019. Individual group results were as follows:

- Large Jets: Worsened (increased) 1.0% for the month, but the figure was better than the group’s 12-month average.

- Medium Jets: Worsened by 0.7%, but the figure was only slightly above (worse) than last month’s 12-month best number.

- Small Jets: Suffered greatly from the reconstituted inventory, increasing 15.3% to set a 12-month worst (high) figure.

- Turboprops: At the other end of the spectrum, Turboprops posted a 12-month low (best) figure through a 3.6% decrease.

July’s ETP Ratio Trend

The inventory’s ETP Ratio rose (worsened) to 71.2%, from June’s 69.9%, following three consecutive monthly improvements (decreases), bringing our tracked fleet to just below its worst (highest) 12-month figure.

The ETP Ratio calculates an aircraft's Maintenance Exposure as it relates to the Ask Price. This is achieved by dividing an aircraft's Maintenance Exposure (the financial liability accrued with respect to future scheduled maintenance events) by the aircraft's Ask Price.

As the ETP Ratio decreases, the asset's value increases (in relation to the aircraft's price). ‘Days on Market’ analysis has shown that when the ETP Ratio is greater than 40%, a listed aircraft’s Days on the Market (DoM) increases, in many cases by more than 30%.

During Q2 2020, aircraft whose ETP Ratio was 40% or greater were listed for sale nearly 53% longer than assets with an ETP Ratio below 40% (251 days versus 384 days). How did each group fare during July?

- Turboprops: For the eighth consecutive month, Turboprops registered the lowest ETP Ratio at 41.8%, a 12-month low (best) figure that continued earning them the top spot among the four groups.

- Large Jets: Improved for the third straight month, this time to 61.4% from June’s 64.0%, thereby remaining in second place.

- Medium Jets: Deteriorated (rose) slightly to 73.7% from June’s 73.4%, with the figure remaining better (lower) than the group’s 12-month average.

- Small Jets: Made the environment for many sellers even more challenging through a Ratio increase to 96.5%, a 12-month high figure that was substantially worse than June’s 85.8%.

Excluding models whose ETP Ratio was over 200% during one of the previous two months (considered outliers), following is a breakdown of the business jet and turboprop models that fared the best and worst during July 2020.

Most Improved Models

All six ‘Most Improved’ models posted a Maintenance Exposure decrease (improvement). Ask Price, on the other hand, was not as uniform, with the Beechcraft King Air C90, Bombardier Global Express, and Cessna Citation II, posting decreases of $5,976, $101,143, and $23,789, respectively. The remaining models experienced the following price increases:

- Gulfstream GIV-SP (MSG3): +$2,102,500

- Dassault Falcon 50: +$84,286

- Beechcraft King Air B200 (pre-2001): +$9,247

Gulfstream GIV-SP (MSG3)

Eclipsing all models in July is the one that occupied the ‘Most Deteriorated’ spot during our June analysis. It earned the top position through a Maintenance Exposure decrease exceeding $852k, along with an Ask Price increase exceeded $2.1m. But that does not bring visibility to the full story.

There were two aircraft listed ‘for sale’ in June carrying Ask Prices. When the asset carrying an Ask Price approximately one-third lower than the remaining one sold, the figure naturally shifted dramatically.

Still, there’s no getting around the model’s substantial improvement in Maintenance Exposure, derived through the single July transaction and three additions to inventory. With an ETP Ratio of 55%, and with inventory at only five units (5.6% of the active fleet), sellers should have some realistic opportunities to trade their aircraft, assuming price expectations are sensible.

Beechcraft King Air C90

Our research uncovered two aircraft trades in July, and the 47 units comprising the latest inventory mix equated to 12.1% of the active King Air C90 fleet – hardly the stuff of legend.

While the model’s Maintenance Exposure decrease of $71k far exceeded its Ask Price reduction, the resulting 116.6% ETP Ratio does not hold much promise for sellers. Buyers, on the other hand, have their pick of the litter.

Dassault Falcon 50

Two units found new owners in July. The remaining inventory of 23 aircraft equated to 12.3% of the active fleet. While the ‘for sale’ fleet saw Maintenance Exposure decrease over $33k and Ask Price increase more than $84k, the resulting ETP Ratio still exceeded 126%.

Although statistically deserving of its spot on the ‘Most Improved’ list, it is doubtful that sellers will experience a dramatic change in fortune although, for some buyers, this may still be the perfect solution for their geographic operating environment.

Beechcraft King Air B200 (Pre-2001 Models)

The second King Air model to occupy a spot on this month’s ‘Most Improved’ list definitely belongs here. Four units traded in July, and the 55 aircraft listed for sale create good selection for buyers, while sellers can benefit from availability only equating to 7.1% of the active fleet.

The model’s ETP Ratio, at 46.2%, is also a great deal more conducive to deal-making and resulted from a Maintenance Exposure drop exceeding $70k and a slight Ask Price increase.

Bombardier Global Express

By no means a stranger to this list, the Global Express gained its position in July following a Maintenance Exposure decrease approaching $393k that was overshadowed an Ask Price decrease exceeding $101k.

We did not record a sale during July, and the model’s 21 listed units equate to 14.6% of the active fleet. However, with an ETP Ratio of 67%, and considering the aircraft’s capabilities and industry following, sellers should have more opportunities than sellers of many other models posting such figures.

Cessna Citation II

Occupying the final slot on July’s ‘Most Improved’ list is a model whose constituents range in age from 25 to 42 years, and whose 83 inventory units equate to 16.5% of the active fleet. For buyers not afraid to become the final owner of an asset within the Small Jet range, the Citation II might be worth considering, as Ask Price fell nearly $24k in July while Maintenance Exposure improved (decreased) over $55k.

Of course, the aircraft’s actual Maintenance Exposure could make your acquisition a bit more expensive that planned, considering the ETP Ratio stood at nearly 128% when last calculated.

Most Deteriorated Models

All six models on July’s ‘Most Deteriorated’ list registered a Maintenance Exposure increase. The Bombardier Learjet 36A posted no Ask Price change, while the remaining models experienced the following decreases:

- Cessna Citation ISP: -$58,192

- Bombardier Learjet 55: -$26,071

- Gulfstream GIV-SP: -$348,000

- Hawker Beechjet 40: -$75,000

- Gulfstream GIV: -$11,111

Cessna Citation ISP

The best aircraft among July’s ‘Most Deteriorated’ assets held the second-highest position on June’s ‘Most Improved’ list. Its dramatic change in stature came from a $7k Maintenance Exposure increase, along with a $58k drop in Ask Price.

As if the model’s 128.5% ETP Ratio posed an insufficient challenge for sellers, inventory stood at 20% of the active fleet (55 units) as we closed out July. Three aircraft did trade last month, but this model’s fleet is aged between 35 and 43 years of age, so prospective buyers need to keep in mind that any future resale is unlikely to generate a price much above salvage value.

Bombardier Learjet 55

First the good news: One asset transacted last month and we did not record any additions to the Learjet 55 inventory.

Now the bad news: The 14 units listed for sale equate to 14.6% of the active fleet for an asset whose ETP Ratio is 188% (by virtue of Maintenance Exposure increase exceeding $55k and an Ask Price decrease of more than $26k).

Ask Prices for this model range between just below $500k to just below $1.0m. For an aircraft aged 33 to 39 years, even the low end of the pricing spectrum will be challenging for sellers to achieve, unless they can effectively monetize their aircraft’s Maintenance Equity.

Gulfstream GIV-SP

Three transactions took place in July proving, yet again, this model’s strong following. However, with a Maintenance Exposure increase approaching $487k, along with an Ask Price decrease of $348k, the GIV-SP, unlike those operated under MSG3 Maintenance rules (see above), found its way onto the ‘Most Deteriorated’ list.

While the 19 aircraft listed for sale represent only 9.1% of the active fleet, the model’s 97% ETP Ratio will make selling against its MSG3 brethren challenging for most existing owners, especially if the aircraft’s engines are not enrolled on an Hourly Cost Maintenance Program.

Hawker Beechjet 400

This 31 to 34-year-old model joined the ‘Most Deteriorated’ list having completed no transactions during July. It did so on its Maintenance Exposure weakness which increased (worsened) over $25k, along with a $75k reduction in Ask Price.

Only four units are listed for sale. Unfortunately for sellers, that equates to 12.1% of the active fleet, while the model’s average ETP Ratio, at over 131%, equates to a challenging selling environment.

Gulfstream GIV

The third Gulfstream model to make either list finds itself in the second worst position among July’s ‘Most Deteriorated’ group.

Two aircraft transacted in July to lower the number available for sale to 21 units (12.4% of the active fleet). Unfortunately, at the ripe old age of 27 to 34 years, this superb aircraft is beginning to reach its financial obsolescence through an ETP Ratio approaching 185%, due to a Maintenance Exposure increase exceeding $477k, along with another Ask Price reduction.

Bombardier Learjet 36A

With an ETP Ratio approaching 185%, and units that are as much as 44 years old, it is not difficult to understand why this model occupied the most deteriorated spot on July’s list. What might be surprising is that one aircraft did trade in July, and only four are listed for sale.

Unfortunately, those listings equate to 10.8% of the active fleet whose Maintenance Exposure increased by more that $306k by virtue of the latest inventory mix.

While air ambulance work has kept this model flying, it, too, is staring at financial obsolescence with some units probably already at that destination.

The Seller’s Challenge

It is important to understand that the ETP Ratio has more to do with buyer and seller dynamics than it does with either the asset’s accrued maintenance or its price. For any aircraft, maintenance can accrue only so far before work must be completed.

But as an aircraft’s value decreases, there will come a point when the accrued maintenance figure equates to more than 40% of the aircraft’s ask price. When a prospective buyer adjusts their offer to address this accrued maintenance, the figure is all-too-often considered unacceptable to the seller and a deal is not reached.

It is not until an aircraft undergoes some major maintenance that a seller is sufficiently motivated to accept a lower figure, or a buyer is willing to pay a higher price and the aircraft transacts, ultimately.

A wise seller needs to consider the potential marketability impact early maintenance might have on their aircraft, as well as its enrollment on an HCMP where more than half of their model’s in-service fleet is enrolled on one.

Sellers also need to carefully weigh any offer from a prospective buyer against the loss in value of their aircraft for sale as the asset spends more days on the market awaiting a better offer, while simultaneously accruing a higher maintenance figure.

More information from www.assetinsight.com.

This article was originally published by AvBuyer on August 14, 2020.

-

NAFA Administrator posted an articleNAFA member, Adam Meredith, discusses the hidden or unexpected costs of aircraft ownership. see more

NAFA member, Adam Meredith, President of AOPA Aviation Finance Company, discusses the hidden or unexpected costs of aircraft ownership.

Major hidden costs, for example, can result when a previous owner has deferred maintenance. You’re better off buying an airplane that’s been regularly used because the owner will typically address issues as they arise in order to continue using the plane regularly.

It’s a myth that it’s smart to look for an aircraft that’s had low flying time. Less wear and tear on the engine and the airframe? While those are important considerations, they should not be the only ones. After all, these are machines and machines are made to be run. When an aircraft sits, its problems remain hidden.

Low flying time could mean high maintenance when it’s your time to own the airplane. That’s one reason the first annual inspection can be unusually expensive — another hidden cost. So be prepared.

Here is a list of other hidden costs associated with aircraft ownership:

- Expenses incurred when an airplane is tied down outside (as opposed to protected in a hangar), including repainting and reskinning the exterior and replacing or repairing instrument panels, aircraft seats, interiors or even sun-crazed windows.

- Contaminated fuel, or more likely, a lineman who accidentally fills your gas tanks with the wrong fuel.

- Unforeseen mechanical failures or mishaps, such as a blown tire, a gear door jamming, a baggage door opening in flight and ejecting an object that damages an elevator or tail surface, etc.

- Compliance with unforeseen airworthiness directives (ADs).

- Animal strikes, bird strikes, lightning strikes, prop strikes, strikes by another aircraft taxiing into you.

- Mud daubers corrupting your pitot-static system or rodents chewing through electrical cables or nesting in your push-pull tubes.

- Sudden failure of one or more instruments, navigation radios or engine monitors.

- Even a pandemic.

The list is extensive but not exhaustive. Hence our advice to add 10% to 15% on top of your projected operations budget, so when those hidden costs reveal themselves, you aren’t surprised.

This article was originally published by AOPA Aviation Finance Company on June 10, 2020.

-

NAFA Administrator posted an articleNAFA member, David Norton, partner at Shackelford Law, shares presentation on Part 91 Dry Leasing. see more

NAFA member, David Norton, partner at Shackelford, Bowen, McKinley & Norton, gave a presentation on Part 91 Dry Leasing, which was immediately followed up with a panel discussion on illegal charters, the two topics going hand-in-hand.

According to Norton, a wet lease is defined as the "aircraft plus crewmember," and a "dry" lease as a mere equipment lease of the aircraft. Some aircraft owners, shying away from key legal, logistical and cost differences between Part 91 and Part 135 operations, enter into dry leasing agreements seeking to raise revenue with their aircraft while letting others operate the aircraft. If not done properly, Part 91 dry leasing can result in penalties from the FAA and refusal of insurance coverage when incident occurs.

The key question is whether operational control is transferred or if an air transportation service is actually being provided. Norton says that "operational control" continues to be a confusing term among owners and pilots, but essentially boils down to who gets to stay where an airplane is going on a given day.

"Pilots will say they have operational control, but unless they are the aircraft owner or the aircraft is leased to them personally, pilots are generally not in operational control of the airplane," said Norton. "The operator is generally a company or person who has the right to say where [the aircraft] is going on a given day, and for [business jets] that means you're usually hiring a professional pilot. So it's not necessarily the person whose hands are on the yoke acting as the operator."

This article was originally published by Shackelford, Bowen, McKinley & Norton in The Binder, Vol. 45 No. 2 - Summer 2020 - on August 4, 2020.

-

ArticleSky Allies Capital Joins National Aircraft Finance Association see more

FOR IMMEDIATE RELEASE

EDGEWATER, Md. – Nov. 13, 2019 – National Aircraft Finance Association (NAFA) is pleased to announce that Sky Allies Capital has recently joined its professional network of aviation lenders.

“NAFA members form a network of aviation finance services who diligently and competently operate with integrity and objectivity throughout the world. We’re excited to welcome Sky Allies to our growing organization as we head to our 50th anniversary,” said Jim Blessing, president of NAFA.

Sky Allies is a group of finance and aviation industry professionals – financing and leasing airplanes, helicopters, flight simulators and other aviation or industrial and technological equipment. The company specializes in credit challenged borrowers and other abnormal deal opportunities. They also offer special hourly simulator leasing programs for flight schools.

The company is privately held and based in Las Vegas, NV. Sky Allies is a member of the American Association of Commercial Finance Brokers and thereby adhere to a Code of Ethics Program as voted on by their broker members. Their principal has 26 years experience in the aviation industry, is a Citation 525 rated pilot, ATP and an airplane owner.

Much like NAFA, Sky Allies Capital is focused on the financing of aircraft – putting business plans in the air. Sky Allies and NAFA are committed to the highest level of customer service, fostering long lasting business relationships throughout the aviation industry.

For more information about Sky Allies Capital, visit nafa.aero/companies/sky-allies-capital.

About NAFA:

The National Aircraft Finance Association (NAFA) is a non-profit corporation dedicated to promoting the general welfare of individuals and organizations providing aircraft financing and loans secured by aircraft; to improving the industry's service to the public; and to providing our members with a forum for education and the sharing of information and knowledge to encourage the financing, leasing and insuring of general aviation aircraft. For more information about NAFA, visit NAFA.aero.

-

ArticleNAFA Announces Dawn Hudson as Keynote Speaker for 49th Annual Conference see more

NAFA Announces Dawn Hudson as Keynote Speaker for 49th Annual Conference

FOR IMMEDIATE RELEASE

EDGEWATER, Md. – November 11, 2019 – The National Aircraft Finance Association (NAFA) is pleased to announce that Dawn Hudson will be the keynote speaker at their upcoming 49th Annual Conference, to be held April 28th through May 1st, 2020, at The Meritage Resort in Napa Valley, California. Hudson will be presenting to an audience of aviation industry and finance experts with a global reach – supporting or enabling the financing of general and business aviation aircraft throughout the world.

Widely recognized as one of the most important female business executives of the past decade, Dawn Hudson is the former Chief Marketing Officer at the National Football League and the former President and CEO of Pepsi Cola North America. She has led an impressive career spanning high-level posts in media, retail, consumer goods, consulting, and healthcare at some of the biggest corporations in the world.

Hudson’s work has been focused on revolutionizing and strengthening brands’ positioning and marketing, tapping into culture change as fuel for innovative business strategies, and championing inclusive leadership and diversity. She has been recognized as the “Most Vital Leader in Tech, Media, and Marketing” by AdWeek – topping a list of 50 industry titans – and twice as one of Fortune magazine’s “50 Most Powerful Women in Business.”

Dawn Hudson is an electric speaker – as an advocate of smart reinvention and growth, she shares insights on turning adversity into an advantage, building a global presence, and why in today’s business climate innovation must be central to everything from distribution to selling stories to human capital management. Hudson speaks about the power of brand, how to embrace change and drive innovation, and the importance of strong and inclusive leadership.

The 49th Annual Meeting of the National Aircraft Finance Association will bring together the most active aircraft lenders in North America and worldwide to network and discuss issues topical to the industry, including: aviation regulatory changes, banking system regulatory changes, updates on new aircraft entering the marketplace, and other issues pertinent to aircraft buyers and their support systems.

“Dawn Hudson is an amazing mind with sharp insights into driving innovation, leadership and inclusion for successful business practices, and we are thrilled to have her speaking to our members and other attendees at the upcoming conference,” said Jim Blessing, President of NAFA. Hudson will present on “Inclusive Leadership” for the approximately 250 attendees on Thursday, April 30th, 2020. Additional details and time will be determined at a later date – visit NAFA.aero/events for information.

For more information about Dawn Hudson, visit leadingauthorities.com/speakers/dawn-hudson.

About NAFA:

The National Aircraft Finance Association (NAFA) is a non-profit corporation dedicated to promoting the general welfare of individuals and organizations providing aircraft financing and loans secured by aircraft; to improving the industry's service to the public; and to providing our members with a forum for education and the sharing of information and knowledge to encourage the financing, leasing and insuring of general aviation aircraft. For more information about NAFA, visit NAFA.aero.

-

ArticleElevate Jet Joins National Aircraft Finance Association see more

FOR IMMEDIATE RELEASE

EDGEWATER, Md. – October 18, 2019 – National Aircraft Finance Association (NAFA) is pleased to announce that Elevate Jet recently joined its professional network of aviation lenders.

“NAFA members form a network of aviation finance services who diligently and competently operate with integrity and objectivity throughout the world. We’re excited to welcome Elevate Jet to our growing organization as we head to our 50th anniversary,” said Jim Blessing, President of NAFA.

Elevate Jet, a subsidiary of Elevate Holdings, is a trusted and professional single-source set of solutions for private jet owners and flyers, offering aircraft management, corporate shuttle, consultancy, and advisory services. The company has been serving private aviation with professional services since 2003, advising private flyers concerning their aviation interests.

Elevate is a premier aircraft management company founded on the growing need for boutique style aircraft management. The company is designed to align with their clients’ mission profiles, providing highly customized services to private aircraft owners and flyers. Their experienced aviation team has a wealth of industry knowledge and intelligence that ensures exemplary levels of bespoke service in aircraft management and aircraft consultancy.

Much like NAFA, Elevate Jet places great importance on fostering knowledge, experience and trustworthiness throughout the aviation industry, providing the highest levels of professionalism in aviation asset management advisory.

“Elevate Jet takes our fiscal responsibilities to our managed aircraft owners seriously, as well as to the clients that retain us to provide aviation advisory services,” said Patti Ann Sullivan, Executive Vice President – Aircraft Management. “The NAFA forums for discussion of issues impacting the aviation and finance industry, exploration of best practices and review of risk mitigation strategies, along with continuous education benefit the industry and the aircraft owners and flyers that we are fortunate to serve. It is for these reasons Elevate Jet is pleased to be a member of the esteemed NAFA association."

For more information about Elevate Jet, visit nafa.aero/companies/elevate-jet-llc.

About NAFA:

The National Aircraft Finance Association (NAFA) is a non-profit corporation dedicated to promoting the general welfare of individuals and organizations providing aircraft financing and loans secured by aircraft; to improving the industry's service to the public; and to providing our members with a forum for education and the sharing of information and knowledge to encourage the financing, leasing and insuring of general aviation aircraft. For more information about NAFA, visit NAFA.aero.

-

ArticleWintrust Joins National Aircraft Finance Association see more

FOR IMMEDIATE RELEASE

EDGEWATER, Md.– September 16, 2019 – National Aircraft Finance Association (NAFA) is pleased to announce that Wintrust Commercial Finance (WCF), a division of Wintrust Asset Finance, Inc., has recently joined its professional network of aviation lenders.

“NAFA members form a network of aviation finance services who diligently and competently operate with integrity and objectivity throughout the world. We’re excited to welcome Wintrust to our growing organization as we head to our 50th anniversary,” said Jim Blessing, president of NAFA.

WCF is Wintrust’s Texas-based, equipment-focused financing group offering sophisticated loan and lease products to companies throughout the U.S. Within three years of the company’s founding, WCF funded in excess of $1 billion in equipment-secured loans and leases and has continued to grow into one of the largest equipment financing companies in the country.

WCF is backed by Wintrust, a more than $33 billion financial holding company that provides a wide variety of financial services for both personal and business banking needs.

WCF provides an array of tailored aircraft finance products including loans, operating leases, and non-tax leases, offering terms up to 10 years with amortizations up to 25 years with a target transaction size of $5 million to $25 million.

Much like NAFA, WCF cares about the community and the individuals in it, offering the resources and tools of a large company with the personal attention and customer focus of a small business. Wintrust and NAFA are committed to fostering solid customer service through the aviation industry.

“Wintrust Commercial Finance is excited to join NAFA as a contributing member,” said Craig Ault, senior vice president, national sales manager. “This partnership will help us better serve our customers in the aviation industry.”

For more information about Wintrust Commercial Finance, visit nafa.aero/companies/wintrust-commercial-finance or wintrust.com/wcf.

About NAFA:

The National Aircraft Finance Association (NAFA) is a non-profit corporation dedicated to promoting the general welfare of individuals and organizations providing aircraft financing and loans secured by aircraft; to improving the industry's service to the public; and to providing our members with a forum for education and the sharing of information and knowledge to encourage the financing, leasing and insuring of general aviation aircraft. For more information about NAFA, visit NAFA.aero.

About Wintrust

Wintrust is a financial holding company with assets of approximately $33 billion whose common stock is traded on the Nasdaq Global Select Market. Built on the "HAVE IT ALL" model, Wintrust offers sophisticated technology and resources of a large bank while focusing on providing service-based community banking to each and every customer. Wintrust operates fifteen community bank subsidiaries with over 160 banking locations located in the greater Chicago and southern Wisconsin market areas. Additionally, Wintrust operates various non-bank business units including business units which provide commercial and life insurance premium financing in the United States, a premium finance company operating in Canada, a company providing short-term accounts receivable financing and value-added out-sourced administrative services to the temporary staffing services industry, a business unit engaging primarily in the origination and purchase of residential mortgages for sale into the secondary market throughout the United States, and companies providing wealth management services and qualified intermediary services for tax-deferred exchanges.

-

ArticleJet Edge Partners Joins National Aircraft Finance Association see more

FOR IMMEDIATE RELEASE

EDGEWATER, Md.– September 16, 2019 – National Aircraft Finance Association (NAFA) is pleased to announce that Jet Edge Partners has recently joined its professional network of aviation lenders.

“NAFA members form a network of aviation finance services who diligently and competently operate with integrity and objectivity throughout the world. We’re excited to welcome Jet Edge to our growing organization as we head to our 50th anniversary,” said Jim Blessing, President of NAFA.

Jet Edge Partners is a full-service aircraft broker and dealer formed as a division of Jet Edge International. The aircraft sales experts at Jet Edge work to understand the mission profiles, goals, and operational budget of their clientele to ensure they are connected with the best possible aircraft to meet their individual needs.

The company’s team is connected in real time to the movements in the markets and are skilled in projecting future trends in the aviation industry. Throughout their careers, the sales team at Jet Edge Partners have successfully completed aircraft transactions totaling hundreds of millions of dollars.

With offices and sales professionals located throughout the United States, the company provides clients with the knowledge and understanding of the market needed in order to purchase or sell an aircraft with confidence and unmatched customer service.

Jet Edge Partners not only transacts aircraft, but alongside Jet Edge International, it operates, owns, and manages one of the largest fleets in the world, providing clients with operational knowledge and resources unmatched in the industry.

Much like NAFA, Jet Edge Partners promotes knowledge and understanding of the market for confident and timely transactions. Jet Edge and NAFA are committed to the aviation industry and the highest standards of customer service.

For more information about Jet Edge Partners, visit nafa.aero/companies/jet-edge-partners.

About NAFA:

The National Aircraft Finance Association (NAFA) is a non-profit corporation dedicated to promoting the general welfare of individuals and organizations providing aircraft financing and loans secured by aircraft; to improving the industry's service to the public; and to providing our members with a forum for education and the sharing of information and knowledge to encourage the financing, leasing and insuring of general aviation aircraft. For more information about NAFA, visit NAFA.aero.

-

ArticleGAMA Publishes 2019 Second Quarter Aircraft Shipment Data see more

NAFA member, Pete Bunce, General Aviation Manufacturers Association's (GAMA) President and CEO, releases Second Quarter Aircraft Shipment Report.

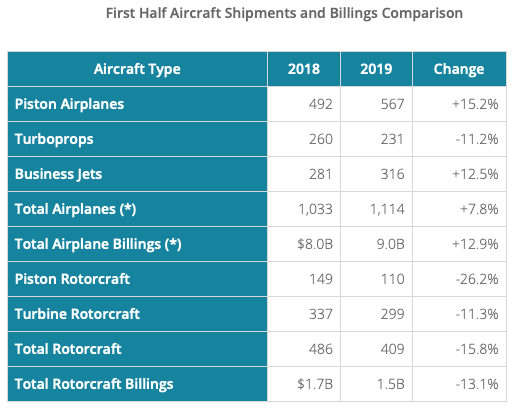

Washington, DC — The General Aviation Manufacturers Association (GAMA) today published a mid-year industry update with the release of preliminary second quarter 2019 aircraft shipment and billings data. Piston and business jet deliveries increased through the first six months of 2019 compared to the same time period in 2018, while turboprop airplane and rotorcraft shipments were lower.

“While the year-to-date aircraft shipments are mixed, this should not obscure the outlook for a bright future for general aviation. Our mid-year report shows new aircraft reaching entry into service milestones with additional models expected to enter into service before the end of 2019,” said GAMA’s President & CEO, Pete Bunce. “Our members remain focused on bringing safety enhancing new technology to the general aviation fleet and upgrading aircraft to meet fast approaching global mandates for Automatic Dependent Surveillance-Broadcast (ADS-B) and datalink communications. Additionally, our industry’s continued emphasis on developing airframes, engines, and avionics that improve fuel efficiency, our aggressive pursuit of hybrid and electrically propelled air vehicles, and promotion of the build out of the Sustainable Aviation Fuel infrastructure, should make us all proud of our collective commitment to environmental sustainability.”

The piston market continued to lead the increase in deliveries at 567 units, up 15.2% from the same period in 2018. Business jet shipments increased by 12.5% in the first six months of 2019 to 316 airplanes delivered. Turboprop airplanes, however, declined in deliveries from 260 to 231 units from the same reporting companies. The value of airplane deliveries through the first six months of 2019 was $9.0 billion, an increase of approximately 12.9%.

Rotorcraft deliveries slowed in the first six months of 2019. Piston rotorcraft shipments declined from 149 units to 110 units. The industry delivered 299 turbine rotorcraft, a reduction by 11.3% compared to 2018. The value of rotorcraft shipments was $1.5 billion, a decline of approximately 13.1%.

Note: Second quarter shipment data was not available from three airplane manufacturers at the time of publication. GAMA will update the report online when the data has been released by the companies. The above comparison table does not include second quarter 2018 data from these three manufacturers.

This press release was originally published by GAMA on August 12, 2019.

-

ArticleGAMA Welcomes Dickson Confirmation as FAA Administrator see more

Washington, DC — July 24, 2019 — The General Aviation Manufacturers Association (GAMA) President and CEO Pete Bunce today issued the following statement on the confirmation of Steve Dickson to serve as the next Federal Aviation Administration (FAA) Administrator:

“We congratulate Steve Dickson on his confirmation by the U.S. Senate. GAMA and its member companies look forward to working with him as the next leader of the FAA.”

“GAMA also strongly endorses Congress passing a waiver to ensure Dan Elwell continues to serve as FAA Deputy Administrator. Mr. Elwell has proven to be a very effective manager and leader at the FAA and will provide important continuity and support as Mr. Dickson takes over as Administrator.”

For additional information, please contact Paul Feldman, Vice President, Government Affairs, +1 (202) 393-1500 or pfeldman@gama.aero.

This release was originally published by GAMA on July 24, 2019.

-

ArticleGreenberg Traurig Joins National Aircraft Finance Association see more

FOR IMMEDIATE RELEASE

EDGEWATER, Md. – Aug. 1, 2019 –The National Aircraft Finance Association (NAFA) is pleased to announce that global law firm Greenberg Traurig, LLP has joined its professional network of aviation service providers.“NAFA members form a network of aviation finance services who diligently and competently operate with integrity and objectivity throughout the world. We’re excited to welcome Greenberg Traurig to our growing organization as we head to our 50th anniversary,” said Jim Blessing, president of NAFA.

Greenberg Traurig’s Business Aviation Practice represents owners and operators of business aircrafts, financial institutions, leasing companies, corporations, airlines, and other aviation-related businesses on a variety of finance, leasing, commercial, and related corporate matters. The team is skilled in advising both domestic and foreign airlines, lessors, and lenders on aircraft, engines, and parts financings; purchases and sales of aircraft and aircraft portfolios; equipment leasing matters; as well as airline investments and other aviation-related commercial and operational matters. Attorneys capitalize on the firm’s global resources by working closely with restructuring, tax, private wealth, antitrust, governmental affairs, intellectual property, environmental, and labor and employment colleagues to develop multifaceted strategies that meet clients’ aviation needs.

Business aviation attorney Edward Kammerer, a longstanding contributor to and recent board member of NAFA, recently joined Greenberg Traurig as a shareholder. He advises the business aviation community on a wide range of transactions and issues, with a special focus on aircraft acquisitions and finance. With 40 years of experience, he represents major corporations, mid-sized companies, family offices, corporate executives, entrepreneurs, and business owners, helping them to acquire, operate, finance, and sell private aircrafts. Kammerer has previously served as in-house counsel for three leading equipment finance companies, including affiliates of two major banks and one leading insurance company. He had responsibility for the development of standard form financing documents and approved documentation of inbound and outbound syndicated secured financings. Kammerer is admitted in New York, Rhode Island, and Connecticut.

About Greenberg Traurig: Greenberg Traurig, LLP(GT) has more than 2,100 attorneys in 41 offices in the United States, Latin America, Europe, Asia, and the Middle East. GT has been recognized for its philanthropic giving, diversity, and innovation, and is consistently among the largest firms in the U.S. on the Law360400 and among the Top 20 on the Am Law Global 100. Web: http://www.gtlaw.com Twitter: @GT_Law.

About NAFA: The National Aircraft Finance Association (NAFA)is a non-profit corporation dedicated to promoting the general welfare of individuals and organizations providing aircraft financing and loans secured by aircraft; improving the industry's service to the public; and providing our members with a forum for education and the sharing of information and knowledge to encourage the financing, leasing and insuring of general aviation aircraft. For more information about NAFA, visit NAFA.aero.

-

ArticleAero Asset Joins National Aircraft Finance Association see more

FOR IMMEDIATE RELEASE

EDGEWATER, Md. - July 29, 2019 - National Aircraft Finance Association (NAFA) is pleased to announce that Aero Asset has recently joined its professional network of aviation lenders. “NAFA members form a network of aviation finance services who diligently and competently operate with integrity and objectivity throughout the world. We’re excited to welcome Aero Asset to our growing organization as we head to our 50th anniversary,” said Jim Blessing, President of NAFA.Aero Asset is a groundbreaking international helicopter sales brokerage with decades of aircraft trading expertise. The company was founded by three well-established aircraft sales professionals: Emmanuel Dupuy, William Sturm and Valerie Pereira. Combining 70-plus years of experience, Aero Asset is a world class broker and dealer of preowned helicopters across configurations and weight class.

Valerie Pereira pilots market research. The growing sales team is lead by Emmanuel Dupuy, William Sturm & Francisco Camoes.

Headquartered in Toronto, Canada, the company promotes its knowledge of helicopter markets by releasing the Preowned Helicopter Market Trendsevery quarter. This in-depth market report ranks preowned twin-engine markets by liquidity, tracks trading values and breaks down sales & supply over the quarter and year on year.

Aero Asset’s Preowned Helicopter Market Trends Q2 report is out now and can be downloaded here:

https://aeroasset.com/pre-owned-market-trends-2019-q2.html

Aero Asset applies big brokerage business practices with a customer-first approach to helicopter sales. Much like NAFA, Aero Asset is passionate about aviation and promoting accurate information for fair and safe transactions. Aero Asset and NAFA are dedicated to the aviation industry and its evolution – setting the highest standards for service and expertise throughout.

For more information about Aero Asset, visit nafa.aero/companies/aero-asset.

About NAFA:

The National Aircraft Finance Association (NAFA) is a non-profit corporation dedicated to promoting the general welfare of individuals and organizations providing aircraft financing and loans secured by aircraft; to improving the industry's service to the public; and to providing our members with a forum for education and the sharing of information and knowledge to encourage the financing, leasing and insuring of general aviation aircraft. For more information about NAFA, visit NAFA.aero.

-

ArticleSOLJETS Celebrates 100 Transactions see more

NAFA member SOLJETS celebrates completion of its 100th company transaction.

PARK CITY, Utah, March 4, 2019 /PRNewswire/ -- SOLJETS, a boutique business aircraft brokerage firm, recently announced its 2018 year-end results to its customer base with a predominant theme of growth. The SOLJETS team completed its 100th company transaction in late Q4 2018, and finished the year at 106 total transactions since the company was founded less than four years ago.

SOLJETS also saw a 10% YoY growth in sales revenue, and a 40% jump in the team's employee count. "We're incredibly proud of our team's achievements the past few years. We've also been humbled by the process of starting and building a business," said David Lee, Co-founder and Partner of SOLJETS. While Lee admitted each deal they've done thus far has had its own challenges, he noted all of them came with lessons learned. "You can't learn the aircraft transaction process by reading a book, nor can you be passive in the transaction itself and hope for a good result. It's creativity, steadfast perseverance, and expansive business and technical acumen that gets deals done these days," mentioned Lee, also adding these are all traits he looks for in all SOLJETS team members.

The company is looking forward to additional growth in 2019. "We recently hired a Regional Sales Director for the Western USA, and we currently have eyes on another two candidates for additional sales coverage in the U.S.," noted Greg Oswald, SOLJETS Co-Founder and Partner, of the company's immediate personnel plans. SOLJETS also just recently finished building their new offices in Park City, Utah. "We're building our future, literally and figuratively," said Oswald.

Of the 106 deals completed through the end of 2018, SOLJETS transacted a myriad of different aircraft types, 32 models to be exact, from light to midsize to super-mid business jets, and even jet fighters. The firm has bought and sold planes in 18 different countries.

ABOUT SOLJETS: Founded in 2015, SOLJETS is a business-aircraft brokerage firm with offices across the United States in Arizona, Atlanta, Boulder, Chicago, Park City, and Sacramento. The unique SOLJETS client-centric model focuses on fostering buyer and seller trust and peace of mind throughout every transaction. SOLJETS serves clients globally and has completed over 100 aircraft transactions…and counting.

SOLJETS. Freedom. Adventure. Delivered.

This article was originally written by SOLJETS and published on PRnewswire on March 4, 2019.

- Valerie Pereira likes this.

-

ArticleGAMA Publishes First Quarter Aircraft Shipment Data see more

NAFA member, Pete Bunce, President and CEO of General Aviation Manufacturers Association (GAMA) releases first quarter 2019 aircraft shipment and billings report.

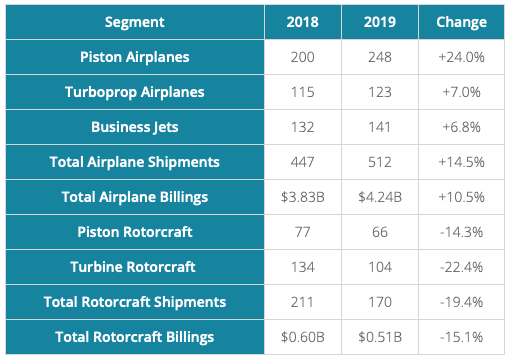

Washington, DC — The General Aviation Manufacturers Association (GAMA) today published its first quarter 2019 aircraft shipment and billings report. Results showed increases across the airplane segments of the industry, but a slowdown in rotorcraft shipments compared to the first quarter of 2018.

“While our rotorcraft segment experienced some headwinds, our airplane segment remains strong,” said GAMA President and CEO Pete Bunce. “Statements by our member companies point to solid order intakes during the first quarter, laying down a positive marker for later in 2019.”

The piston airplane market led the increase in deliveries at 248 units, a 24.0% increase from the same period in 2018. Turboprop and business shipments also increased year-over-year, at 7.0% and 6.8% respectively. Piston rotorcraft shipments in the first quarter of 2019 were 66 units, compared to 77 units in 2018. There were 104 turbine rotorcraft shipments in the first quarter of 2019, compared to 134 in the first quarter last year.

Click here to view the first quarter report.

For additional information, please contact Jens Hennig, GAMA Vice President, Operations, at jhennig@gama.aero.

This press release was originally published by GAMA on May 17, 2019.