Activity

-

ArticleGAMA Publishes 2019 Second Quarter Aircraft Shipment Data see more

NAFA member, Pete Bunce, General Aviation Manufacturers Association's (GAMA) President and CEO, releases Second Quarter Aircraft Shipment Report.

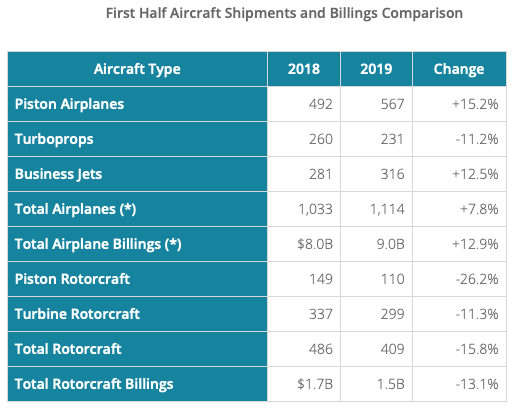

Washington, DC — The General Aviation Manufacturers Association (GAMA) today published a mid-year industry update with the release of preliminary second quarter 2019 aircraft shipment and billings data. Piston and business jet deliveries increased through the first six months of 2019 compared to the same time period in 2018, while turboprop airplane and rotorcraft shipments were lower.

“While the year-to-date aircraft shipments are mixed, this should not obscure the outlook for a bright future for general aviation. Our mid-year report shows new aircraft reaching entry into service milestones with additional models expected to enter into service before the end of 2019,” said GAMA’s President & CEO, Pete Bunce. “Our members remain focused on bringing safety enhancing new technology to the general aviation fleet and upgrading aircraft to meet fast approaching global mandates for Automatic Dependent Surveillance-Broadcast (ADS-B) and datalink communications. Additionally, our industry’s continued emphasis on developing airframes, engines, and avionics that improve fuel efficiency, our aggressive pursuit of hybrid and electrically propelled air vehicles, and promotion of the build out of the Sustainable Aviation Fuel infrastructure, should make us all proud of our collective commitment to environmental sustainability.”

The piston market continued to lead the increase in deliveries at 567 units, up 15.2% from the same period in 2018. Business jet shipments increased by 12.5% in the first six months of 2019 to 316 airplanes delivered. Turboprop airplanes, however, declined in deliveries from 260 to 231 units from the same reporting companies. The value of airplane deliveries through the first six months of 2019 was $9.0 billion, an increase of approximately 12.9%.

Rotorcraft deliveries slowed in the first six months of 2019. Piston rotorcraft shipments declined from 149 units to 110 units. The industry delivered 299 turbine rotorcraft, a reduction by 11.3% compared to 2018. The value of rotorcraft shipments was $1.5 billion, a decline of approximately 13.1%.

Note: Second quarter shipment data was not available from three airplane manufacturers at the time of publication. GAMA will update the report online when the data has been released by the companies. The above comparison table does not include second quarter 2018 data from these three manufacturers.

This press release was originally published by GAMA on August 12, 2019.

-

ArticleGAMA Welcomes Dickson Confirmation as FAA Administrator see more

Washington, DC — July 24, 2019 — The General Aviation Manufacturers Association (GAMA) President and CEO Pete Bunce today issued the following statement on the confirmation of Steve Dickson to serve as the next Federal Aviation Administration (FAA) Administrator:

“We congratulate Steve Dickson on his confirmation by the U.S. Senate. GAMA and its member companies look forward to working with him as the next leader of the FAA.”

“GAMA also strongly endorses Congress passing a waiver to ensure Dan Elwell continues to serve as FAA Deputy Administrator. Mr. Elwell has proven to be a very effective manager and leader at the FAA and will provide important continuity and support as Mr. Dickson takes over as Administrator.”

For additional information, please contact Paul Feldman, Vice President, Government Affairs, +1 (202) 393-1500 or pfeldman@gama.aero.

This release was originally published by GAMA on July 24, 2019.

-

ArticleGAMA Publishes First Quarter Aircraft Shipment Data see more

NAFA member, Pete Bunce, President and CEO of General Aviation Manufacturers Association (GAMA) releases first quarter 2019 aircraft shipment and billings report.

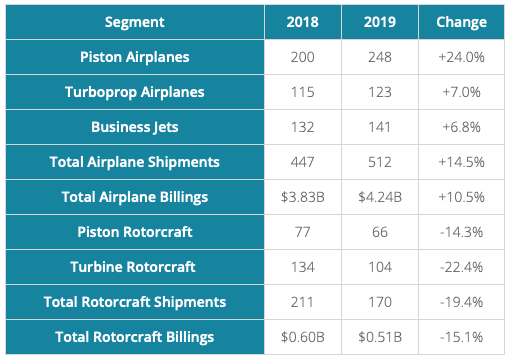

Washington, DC — The General Aviation Manufacturers Association (GAMA) today published its first quarter 2019 aircraft shipment and billings report. Results showed increases across the airplane segments of the industry, but a slowdown in rotorcraft shipments compared to the first quarter of 2018.

“While our rotorcraft segment experienced some headwinds, our airplane segment remains strong,” said GAMA President and CEO Pete Bunce. “Statements by our member companies point to solid order intakes during the first quarter, laying down a positive marker for later in 2019.”

The piston airplane market led the increase in deliveries at 248 units, a 24.0% increase from the same period in 2018. Turboprop and business shipments also increased year-over-year, at 7.0% and 6.8% respectively. Piston rotorcraft shipments in the first quarter of 2019 were 66 units, compared to 77 units in 2018. There were 104 turbine rotorcraft shipments in the first quarter of 2019, compared to 134 in the first quarter last year.

Click here to view the first quarter report.

For additional information, please contact Jens Hennig, GAMA Vice President, Operations, at jhennig@gama.aero.

This press release was originally published by GAMA on May 17, 2019.

-

ArticleNAFA held it's 47th Annual Conference in Coronado, CA from May 15-18, 2018 see more

Coronado, CA., May 25, 2018 – #NAFA47 - The National Aircraft Finance Association (NAFA) held its 47thAnnual Conference May 15-18, 2018 with a record-setting number of member representatives attending. The conference was held at the Hotel del Coronado in San Diego, CA. The four-day event included a 1-day NAFA Aircraft Education Program, a Vendor Forum, Annual Business Meeting and a wide array of aviation and finance-specific Sessions.

With over 240 attendees and $9,380 in donations towards NAFA scholarship fund, this event exceeded expectations! “Year over year, we continue to see marked growth in the Conference”, commented NAFA President Ford von Weise. “Many thanks for our dynamic speakers who kept discussions lively and engaging.”

Keynote speaker this year was John Heilemann, a political reporter, National Affairs Analyst for NBC and MSNBC, Best Selling Author, and Executive Producer of Showtime’s The Circus. He spoke about Donald Trump’s Washington, the Fallout from the 2016 election, and the new realities of our political climate.

Economic Analyst, Dr. LaVaughn M. Henry, spoke to the audience about the state of the U.S. Economy and Monetary Policy. Dr. Henry is a policy analyst for the Federal Deposit Insurance Corporation (FDIC) and Former Vice President of the Federal Reserve Bank of Cleveland and provided insight on the elements influencing our economy today and their potential impact over the next few years.

General session discussions included The State of the Aviation Industry in 2018 headlined by Ed Bolen (President, NBAA), Pete Bunce (President, GAMA) and Marty Hiller (President, NATA). Additional sessions included The Great Financial Meltdown and its impact on the Aviation Industry; a New Aircraft Showcase with presentations by ICON, Textron, Dassault and Aerion; an update on activity in the pre-owned aircraft sales market, and a session on the New Tax Law and its impact in Business Aviation & Lending.

A special THANK YOU to ICON Aircraft who was generous enough to display their ICON A5 on the lawn oceanfront at the hotel during the NAFA Cocktail Reception. This was a first for the hotel and it’s 130-year history and a huge hit for not only NAFA members but the guests at Del Coronado also enjoyed this display!

NAFA would like to thank the conference sponsors: Gold Sponsors– Insured Aircraft Title Services, Global Jet Capital, JetAviation, JSSI, and Rolls-Royce. Silver Sponsors– Aero-Space Reports, Aircraft BlueBook, AIC Title Service, Airfleet Capital Inc., Aircraft Finance Corporation, Aviation Management Systems, AOPA, Asset Insight, Dassault Falcon Jet, Essex Aviation, GKG Law, LL Johns Insurance, PNC Aviation Finance, Salem Five, Scope Aircraft Finance, and Vref. Bronze Sponsors– Aerlex, Aviation Legal Group, Bank of America, Dorr Aviation, Huntington National Bank, NAFCO, Stonebriar Commercial Finance and Wright Brothers Aircraft Title.

About NAFA:

The National Aircraft Finance Association (NAFA) is a non-profit corporation dedicated to promoting the general welfare of individuals and organizations providing aircraft financing and loans secured by aircraft; to improving the industry’s service to the public; and to providing our members with a forum for education and the sharing of information and knowledge to encourage the financing, leasing and insuring of general aviation aircraft. For more information about NAFA, visit the website at www.NAFA.aero