Activity

-

ArticleJack Prewitt & Associates, Inc. Joins National Aircraft Finance Association see more

FOR IMMEDIATE RELEASE

EDGEWATER, Md. - Aug. 23, 2019 - National Aircraft Finance Association (NAFA) is pleased to announce that Jack Prewitt & Associates, Inc. has recently joined its professional network of aviation lenders.

“NAFA members form a network of aviation finance services who diligently and competently operate with integrity and objectivity throughout the world. We’re excited to welcome Jack Prewitt to our growing organization as we head to our 50th anniversary,” said Jim Blessing, President of NAFA.

Jack Prewitt & Associates provides a comprehensive aircraft brokerage and acquisition service developed from extensive knowledge gained over the years of the aircraft markets, allowing them to effectively gauge the needs of their clients. The company prides itself on being an aviation partner with a track record of client success and satisfaction.

The company serves their clients by first establishing what the client’s mission is when acquiring an aircraft, then providing up to date insight into the worldwide aviation marketplace. Their team identifies the best aircraft that fits their customers’ mission and negotiates a fair market price, all while guiding them through the purchasing process from “tip to tail”.

Over the last 40 years, Jack Prewitt & Associates has bought and sold over 1000 aircraft, largely through their extensive, exclusive network of contacts. As an inventory dealer, the company are experienced buyers as well as sellers. Via their leasing subsidiary, AEI, they also own six aircraft, including five large cabin jets, all on long-term lease. The company believes this varied experience sets them apart from the rest of the field.

Much like NAFA, Jack Prewitt & Associates, Inc. has experience in all facets of aviation and provides accurate market knowledge. Jack Prewitt and NAFA are passionate about the aviation industry and promoting excellence in service.

For more information about Jack Prewitt & Associates, Inc., visit nafa.aero/companies/jack-prewitt-associates-inc.

About NAFA:

The National Aircraft Finance Association (NAFA)is a non-profit corporation dedicated to promoting the general welfare of individuals and organizations providing aircraft financing and loans secured by aircraft; to improving the industry's service to the public; and to providing our members with a forum for education and the sharing of information and knowledge to encourage the financing, leasing and insuring of general aviation aircraft. For more information about NAFA, visit NAFA.aero.

-

ArticleGAMA Publishes First Quarter Aircraft Shipment Data see more

NAFA member, Pete Bunce, President and CEO of General Aviation Manufacturers Association (GAMA) releases first quarter 2019 aircraft shipment and billings report.

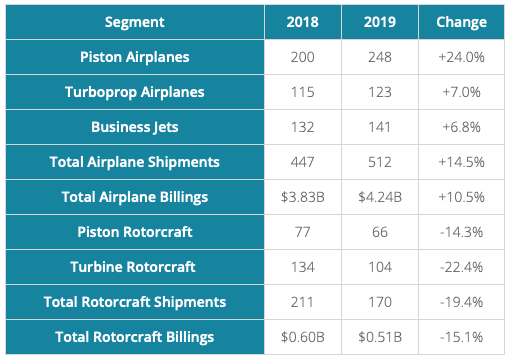

Washington, DC — The General Aviation Manufacturers Association (GAMA) today published its first quarter 2019 aircraft shipment and billings report. Results showed increases across the airplane segments of the industry, but a slowdown in rotorcraft shipments compared to the first quarter of 2018.

“While our rotorcraft segment experienced some headwinds, our airplane segment remains strong,” said GAMA President and CEO Pete Bunce. “Statements by our member companies point to solid order intakes during the first quarter, laying down a positive marker for later in 2019.”

The piston airplane market led the increase in deliveries at 248 units, a 24.0% increase from the same period in 2018. Turboprop and business shipments also increased year-over-year, at 7.0% and 6.8% respectively. Piston rotorcraft shipments in the first quarter of 2019 were 66 units, compared to 77 units in 2018. There were 104 turbine rotorcraft shipments in the first quarter of 2019, compared to 134 in the first quarter last year.

Click here to view the first quarter report.

For additional information, please contact Jens Hennig, GAMA Vice President, Operations, at jhennig@gama.aero.

This press release was originally published by GAMA on May 17, 2019.

-

ArticleGlobal Jet Capital Reveals Importance of Financing in Driving Shift to Larger Aircraft see more

NAFA member, Global Jet Capital, estimates the value of financing biz jets almost $23bn!

New analysis from Global Jet Capital, a global leader in financial solutions for business aircraft, has revealed the important role financing is playing in driving the growth in business aviation.

Since the beginning of 2016, Global Jet Capital estimates that there have been over 8,600 new and used business aircraft transacted around the globe, with the value of financing used to support those purchases totaling almost $23bn. Notably, over 60% of that financing, some $14bn, has been towards acquisitions of new and used large/heavy aircraft.

This financing has helped increase the proportion of larger aircraft within the global fleet. Since 2016 the total number of mid-sized aircraft around the world has fallen by 8%, or 415 planes. However, these aircraft have been almost exactly replaced in number by larger models as the heavy/large jet segment has grown by 419 aircraft, a 6% increase.

As the average purchase value of new aircraft in this larger segment was over $48.2m between 2016-2018, compared to an average of $12.5m for the balance of the market, this focus on larger aircraft provides a significant boost to the overall industry. Indeed, the overall value of deliveries of new large or heavy jets since 2016 totals $26.4bn, compared to a total figure of $14.3bn for the balance of the market.

Global Jet Capital estimates that operating leases to the value of over $5bn are held against new and used aircraft transacted since 2016. The company has seen a significant increase in inquiries for operating leases, with clients attracted by advantages including flexibility and reduction in residual risk. Global Jet Capital expects to see growth in operating leases of over the coming five years, helping drive further aircraft acquisition.

Of all global regions, only Africa has seen a drop in the size of its large aircraft fleet with a 2% decrease since 2016. The Middle East has remained static over this period, while all other regions have seen growth, the most significant in Latin America and the Caribbean, North America and Asia Pacific (with 8%, 7% and 6% increases respectively). North America has witnessed the largest increase in real terms, adding 317 aircraft to its large and heavy fleet, consolidating its position as the global leader for business jets.

Dave Labrozzi, chief operating officer at Global Jet Capital said: “The figures provide a clear focus of where we are seeing expansion in the sector, and the importance of financing in supporting industry growth. The flexibility afforded by operating leases is especially beneficial in helping clients move on to higher value new model aircraft without having to remarket their existing aircraft.

“There are significant long-term advantages in increasing the number of larger business jets in the global fleet. These obviously provide greater capacity per aircraft and therefore offer the benefits of business aviation to a wider population, something which can be particularly important for corporate owners. In addition, the increasing importance in developing new international trade links is resulting in growing demand for aircraft able to undertake longer distances to destinations which may not currently be well served by commercial airlines.”

This article was originally published by Global Jet Capital on October 17, 2018.

-

ArticleTips for Comparing Aircraft Operating Costs see more

NAFA member, David Wyndham, Vice President at Conklin & de Decker, details the process of a Life Cycle Cost analysis and underlines its importance to any aircraft buyer.

A consulting client I worked with was evaluating Large Cabin business jets. Initially the client was more concerned with minimizing the operating expenses and less concerned with the capital costs. As long as the acquisition price fitted within their $25m budget, they would be satisfied.

Yet those evaluating business jet ownership should be concerned with more than just the acquisition costs. They should also factor operating costs (variable and fixed), amortization, interest, depreciation, taxes and the cost of capital. Items like depreciation, interest and taxes – for example - can add as much as 60% to the Aviation Department’s costs depending on the value of the aircraft.

Furthermore, you should also consider when the costs occur.

General Methodology for Life Cycle Costing

When analyzing the potential acquisition of a whole aircraft or a share of one, Life Cycle Costing ensures that all appropriate costs should be considered.

The Life Cycle Costing includes acquisition, operating costs, depreciation and the cost of capital. Amortization, interest, depreciation, and taxes also play a part in what it costs to own and operate an aircraft and can be included in the Life Cycle Costing as appropriate.

The first step is to know what aircraft to evaluate. This is achieved with an understanding of the key missions and the technical analysis of all potential aircraft. You need to be sure you are not buying more (or less) aircraft than you need.

There should be no room for assumption in the process. The costs should cover a specific period and take into account the aircraft’s expected value at the end of the term of ownership.

Comparisons of two or more aircraft should cover the same period of time and utilization, ensuring an apples-to-apples comparison is provided.

On the subject of utilization, you are advised to use miles if the aircraft is flying point-to-point and convert each aircraft to hours based on their speed. To have an accurate comparison, you will need to measure performance using the same criteria. Different aircraft fly at different speeds. Using a mile-based measurement accounts for the speed differences between aircraft.

I also recommend that you have a baseline. If an existing aircraft is to be replaced, that aircraft becomes the baseline. If you charter or own a fractional share in an aircraft, then continuation of that charter or fractional share would be the baseline.

The baseline essentially forms a basis for the comparison, establishing whether the new option under consideration costs less than the current baseline or more. If the cost will be more, what is the value of the increased cost?

Net Present Value Analysis

A complete Life Cycle Cost accounts for the time-value of money in a Net Present Value (NPV) analysis. Using NPV enables the differing cash flows from two or more options to be compared and analyzed from a fair and complete perspective.

An NPV analysis takes into account the time value of money, as well as income and expense cash flows, type of depreciation, tax consequences and residual value of the various options under consideration.

When an expense (or revenue) occurs can be as important as the amount of that item. This is useful in the comparison of Cash Buy vs Lease vs Finance options for the same aircraft.

Business aircraft do not directly generate revenue except for the sale of the aircraft. Thus, the NPV results are typically negative.

When comparing negative NPVs, the "least negative NPV" is the more favorable. In other words, if Option A has an NPV of $5m and the NPV of Option B is $6m, Option A has a better NPV.

You may want to run several scenarios. For example, what if you owned the aircraft for five years? How about ten? What if utilization was increased? What is the break-even point to move from fractional ownership to whole ownership? There may be many possible best alternatives when you adjust the important criteria.

In Summary

Regarding the client mentioned above, we evaluated new and used business aircraft and found several options that were at the top of the acquisition budget had lower total life cycle costs than aircraft with lower acquisition prices.

A Life Cycle Cost analysis is an important decision-making tool, but it is not the answer all by itself. I like to use the term "Best Value" in combining both the capabilities and the costs of the various options analyzed.

Run the numbers and use them in your decision - but remember: Never let a spreadsheet make the decision for you.

This article was originally published Conklin & de Decker in AvBuyer on June 25, 2018.

-

ArticleBusiness Aircraft: How to Quantify the Time Saved see more

NAFA member, David Wyndham, Vice President and Director of Business Strategy, with Conklin & de Decker, discusses the need to consider QUALITY of time saved with business aircraft.

Business aircraft provide many advantages for busy CEOs. Yet David Wyndham demonstrates that simply measuring time savings does not give the full picture…

The July/August edition of Harvard Business Review published the results of research looking at how CEOs spend their time. The study collected, coded and analyzed data for over 60,000 CEO-hours in 15-minute increments. The average annual revenue of the companies these CEOs run is $13.1bn.

The data was well researched and quantified, and it proved what seems obvious: CEOs are busy people. What also should become clear is the benefits that a business aircraft can have for these busy individuals, when used effectively.

To fully grasp those benefits, however, we need to consider more than just the time saved by using business aircraft. We need to consider the quality of that time, too.

The Travel Need

One take-away from the study is that where CEOs choose to spend their time is critical to their own effectiveness and signals the priorities for others within the company.

According to the research, about half of the polled CEO’s work time was spent outside the company headquarters – so with the CEOs averaging 62.5 hours a week, about 33 hours are spent outside of headquarters.

Face-to-face communication is the best way to learn what’s going on and to demonstrate to the entire organization what’s important. Spending time with frontline employees, on the factory floor, in the showroom and out in the field demonstrates more than any well-crafted email or video that everyone has an important role to play towards the success of the company.

These frontline visits also enable the CEO to get reliable information as to what is going on. Sales are an indicator of the health of a company, but so is talking with the sales clerk at the store. CEOs need to meet with investors, senior leadership teams, divisions heads, the board of directors and more.

More than one-third of a CEO’s time was found to be spent reacting to and dealing with unfolding developments. This could be a crisis (i.e. a fire shutting down a factory, a developing trade war impacting future costs, a strike), or an opportunity to purchase a competitor or complimentary organization.

Meanwhile, spending time with customers is also considered important, though the study showed that CEOs only spend about 3% of their time with customers, relying on others within the organization to be the interface.

The CEOs polled within the research felt this was too little time.

All the above should indicate clearly that a CEO is on-the-move, needs to be in many places, and plenty of travel is required to enable them to be face-to-face. The use of a business aircraft comes to mind of course, but why not just use the airlines?

The Business Aircraft Travel Advantage

We’ve highlighted many times before how the use of business aircraft results in less time spent traveling. Much of the travel time reduction is the result of being able to travel to airports located convenient to the facility or customer; direct, non-stop flights (avoiding the need for connecting flights); and the fact that the business aircraft departs and waits on the CEOs schedule.

In studies I’ve undertaken with clients, the travel time differences can range from a few hours to several days. I had one client that could fly to their plant in Nevada, have a four-hour meeting, and return home in a 12-hour day on the business aircraft. Undertaking that same trip via the airlines would have cost the client two nights away from home, due to the poor Airline connections.

Yet even with city pairs well served by the airlines (i.e. New York to Chicago or London to Berlin) the business aircraft can take less time – and given the demands on a CEO’s time even an additional two hours weekly can be worth their weight in gold.

The Business Aircraft Quality Advantage

Business aircraft add value in other ways that airline travel cannot, taking us into the realm of quality of time. For example, the Harvard Business Review’s study also discussed the urgent need for CEOs to find room to think, reflect, relax, exercise and eat well.

For many CEOs the time spent in a business aircraft gives them the space and opportunity to think and reflect. Brain research is showing that this quiet downtime, which was once thought of as unproductive, is necessary for the human brain to function at its most effective.

Little opportunity is provided in a security queue, sitting on a packed Scheduled Airline flight, or waiting for a cab for anyone to reflect and be thoughtful.

That four-hour round trip on a business aircraft, combined with allowing the time for a morning run and still being home for the kids’ bedtime is incredibly valuable to a CEO’s mental health and well-being to manage the immense demands placed on them every single day.

The quality of the time spent on the business aircraft in whatever way the CEO decides to use it may just be the secret weapon of the super-effective CEO.

This article was originally published in AvBuyer on September 25, 2018.

-

ArticleJetcraft Releases Fourth Annual 10-Year Business Aviation Market Forecast see more

NAFA member, Jetcraft, has released the findings from its fourth annual 10-year business aviation market forecast, building upon the 2017 prediction of a new business cycle of steady, healthy growth and expanding revenues.

Jetcraft, the global leader in business aircraft sales and acquisitions, is today releasing its fourth annual 10-year business aviation market forecast.

The annual market forecast reaffirms that steady growth in the private jet industry is set to continue, with predictions of 8,736 unit deliveries over the next 10 years, representing $271bn in revenues (based on 2018 pricing). North America will once again take the lead, accounting for 60% (5,241) of predicted new unit deliveries over the forecast period, with Europe expecting 18% (1,572), and Asia-Pacific 13% (1,136).

Jahid Fazal-Karim, Owner and Chairman of the Board at Jetcraft, says: “2018 has been a real turning point for business aviation, as we have now successfully navigated through our industry’s most difficult period. This year’s forecast predicts the continuation of our current business cycle of steady and healthy growth, driven by an increase in wealth creation and the demand for larger and more expensive aircraft.”

The increase in wealth creation over the past decade has spurred growth in family offices that are now offering a wide variety of specialized services, including business aviation. Together with the increase in block charter and fractional programs, this is exposing more UHNWIs to the industry than ever before.

However, despite continued economic growth, Fortune 500 companies have yet to return to historical aircraft transaction levels, due to maintaining a focus on other financial priorities, such as share buybacks and paying down debt. This customer segment is unlikely to restart aircraft purchasing programs until well into the cycle.

The forecast predicts that the large jet category, comprising super large, ultra long range and converted airline segments, will constitute 32% of total units (2,778) and 64% of total revenue over the next decade. All new aircraft model programs, both announced and projected, during the forecast period are exclusively widebodies.

Fazal-Karim adds: “Predicted unit deliveries in the large jet category account for a huge proportion of total revenues in the industry, demonstrating the trend towards larger, long range aircraft to support today’s global business needs.”

While the industry is set to embark on a period of substantial growth, its resilience during the challenges of the previous business cycle has prepared it well for expansion.

Fazal-Karim concludes: “We’re confident that the lessons we’ve learned over the past decade will ensure sustainable growth for business aviation in the years to come. Ours is an enduring industry, and one with a buoyant future ahead.”

Jetcraft’s full 2018 10-year Business Aviation Market Forecast is available to download here. Report graphs available for publication on request.

This market report was originally published by Jetcraft on October 10, 2018.

-

ArticlePrivate Aircraft Ownership - A More Productive Method of Business Travel. see more

NAFA member, PNC Aviation Finance shares the advantages of private aircraft ownership.

Private aircraft ownership can often invoke images of celebrities jet-setting to exotic locations around the world. In reality, purchasing a private aircraft can save money and offer enhanced opportunities for corporations and businesses owned by high-net-worth individuals.

High-net-worth individuals and corporate executives want to save time and travel quickly to conduct business.

Private and business aircraft ownership can have a positive impact by allowing executives to set their own schedules and grow their business without being at the mercy of commercial airlines. This advantage can save money and could potentially offset the cost of the private aircraft in terms of cost savings, the ability to generate additional business and enhanced travel opportunities.

Rather than viewing the ownership of a private aircraft simply as an expense, in the right situation, it might actually provide a competitive advantage.

Access to Underserved or Remote Locations

The ability to access locations that are “off the beaten track" and not adequately served by regular commercial airline service can be a key advantage of using private aircraft. If your company does business in these types of locations, using a private aircraft can save time wasted in airports, changing flights and renting a car to drive to your ultimate destination[1].

If restricted to commercial schedules, it may be difficult to justify visiting prospects, clients or company locations in these areas on a frequent basis. This can negatively impact your business and affect potential growth opportunities.

Privacy and productivity

On a private aircraft, business can continue without the presence of strangers sitting in the next seat. This appeals to high-net-worth individuals who have privacy and security concerns that can't be guaranteed on commercial flights and at bustling airports.

In some business situations, executives want to ensure their privacy if they are traveling to a sensitive business meeting involving a confidential transaction, such as a potential acquisition or opportunity with a potential new customer[2].

A private aircraft offers an environment conducive for working, conducting meetings with other employees or business associates who are also on the flight or transacting business via phone during flight. This additional productivity can be invaluable as preparation can enhance the chances for success in any business situation.

For business executives, the cost of the flight and related expenses to maintain the aircraft can be more than offset by the convenience of being able to fly to a meeting on your own schedule. Sometimes, just showing up can be what it takes to land a new customer.

Tax Advantages and Issues

Purchasing a private aircraft can offer tax advantages, but this acquisition can be more complex than buying a piece of capital equipment or real estate.

A key issue is the ability to justify that a private aircraft is an ordinary and necessary business expense and not just a luxury or convenience purchase[3].

If an argument can be made that business is normally conducted in locations that have limited or no commercial service, a private aircraft is easier to justify. It can also apply if travel often occurs at the spur of the moment or at irregular times.

Using a private aircraft to address legitimate privacy and security concerns for executives and employees can be another justification.

There can be a number of taxes, such as potential sales and use taxes, associated with private aircraft ownership, one being how the aircraft is owned. Ownership by a separate entity other than the main operating business can lead to tax implications.

Before purchasing a private aircraft, it is wise to have your tax and legal advisers conduct a thorough review in terms of the best ownership structure and the anticipated usage to ensure the best possible tax outcome[3].

Additionally, there are distinct rules regarding the separation of business and personal use of the aircraft. This can extend to personal use as a perk for employees and even in the case of a spouse flying on an executive plane without a business purpose.

It's important to establish rules for usage and to account for travel using a consistent process that meets both internal and external reporting requirements.

The diligent maintenance of usage records and the reason for each passenger being on each flight is critically important[4].

If properly structured and used, the cost of private aircraft ownership can be partially offset by tax benefits that can reduce the cost of ownership.

We Can Help

PNC Aviation Finance offers knowledgeable financing solutions to make private aircraft ownership possible and affordable.

We offer custom-tailored financing packages based on business needs and circumstances. Our experienced aviation finance team understands and has extensive knowledge regarding private aircraft ownership requirements, FAA, insurance, operating leases, etc.

We can help you look at the implications of each option and help you decide on the best option for you or your business.

Learn how PNC Aviation Finance can help you fly higher by visiting pnc.com/aviation.

This article was originally published by PNC Aviation Finance.