Activity

-

ArticleGAMA Welcomes Dickson Confirmation as FAA Administrator see more

Washington, DC — July 24, 2019 — The General Aviation Manufacturers Association (GAMA) President and CEO Pete Bunce today issued the following statement on the confirmation of Steve Dickson to serve as the next Federal Aviation Administration (FAA) Administrator:

“We congratulate Steve Dickson on his confirmation by the U.S. Senate. GAMA and its member companies look forward to working with him as the next leader of the FAA.”

“GAMA also strongly endorses Congress passing a waiver to ensure Dan Elwell continues to serve as FAA Deputy Administrator. Mr. Elwell has proven to be a very effective manager and leader at the FAA and will provide important continuity and support as Mr. Dickson takes over as Administrator.”

For additional information, please contact Paul Feldman, Vice President, Government Affairs, +1 (202) 393-1500 or pfeldman@gama.aero.

This release was originally published by GAMA on July 24, 2019.

-

ArticleGAMA Publishes First Quarter Aircraft Shipment Data see more

NAFA member, Pete Bunce, President and CEO of General Aviation Manufacturers Association (GAMA) releases first quarter 2019 aircraft shipment and billings report.

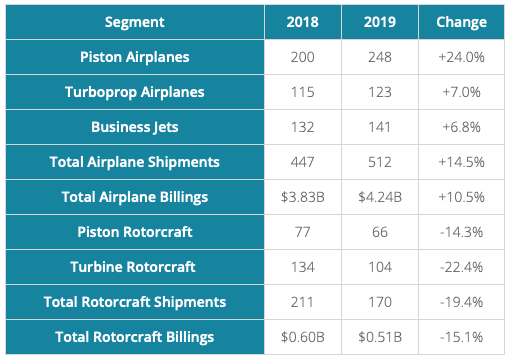

Washington, DC — The General Aviation Manufacturers Association (GAMA) today published its first quarter 2019 aircraft shipment and billings report. Results showed increases across the airplane segments of the industry, but a slowdown in rotorcraft shipments compared to the first quarter of 2018.

“While our rotorcraft segment experienced some headwinds, our airplane segment remains strong,” said GAMA President and CEO Pete Bunce. “Statements by our member companies point to solid order intakes during the first quarter, laying down a positive marker for later in 2019.”

The piston airplane market led the increase in deliveries at 248 units, a 24.0% increase from the same period in 2018. Turboprop and business shipments also increased year-over-year, at 7.0% and 6.8% respectively. Piston rotorcraft shipments in the first quarter of 2019 were 66 units, compared to 77 units in 2018. There were 104 turbine rotorcraft shipments in the first quarter of 2019, compared to 134 in the first quarter last year.

Click here to view the first quarter report.

For additional information, please contact Jens Hennig, GAMA Vice President, Operations, at jhennig@gama.aero.

This press release was originally published by GAMA on May 17, 2019.

-

ArticleLatest Harris Poll Survey Reaffirms Importance of Business Aviation to Companies, Communities see more

NAFA member, GAMA, releases the latest Harris Poll survey findings.

Orlando, FL –– The General Aviation Manufacturers Association (GAMA) today joined with the National Business Aviation Association (NBAA) to release the findings of the latest survey conducted by The Harris Poll demonstrating the value of business aviation in providing safe, efficient transportation to companies of all sizes, particularly those located in smaller communities with little to no commercial airline service.

“The Real World of Business Aviation: 2018 Survey of Companies Using General Aviation Aircraft,” represents a statistically valid representation of the use of business aircraft. The following are among the survey’s key findings:

- Most users of business aviation are small companies employing 500 or fewer workers. Sixty-two percent of pilots and flight department leaders (identified as "pilots" for survey purposes) stated their companies utilize a single, turbine-powered aircraft.

- Many business aircraft are largely flown to towns with little or no airline service, with pilots reporting that, on average, 31.5 percent of their flights over the past year were to destinations lacking any scheduled airline service.

- Scheduling flexibility remains a key driver for business aviation, with 51.6 of passengers stating that traveling on business aircraft enables them to keep business schedules that could not be met efficiently using the scheduled airlines.

- A significant portion of business aircraft passengers are technical specialists, managers and other company employees, as well as customers. These passengers spend an average of 63 percent of their time on board business aircraft engaged in work, compared to just 42 percent when traveling commercially. Furthermore, two-thirds of these passengers say they are more productive on business aircraft flights than when they are in the office.

- During the past year, 38 percent of pilots reported flying business aircraft on humanitarian missions, averaging three such missions annually.

"Since 2009, we've said, 'No Plane No Gain,' and this updated survey confirms the power of the slogan," said GAMA President and CEO Pete Bunce. "General aviation aircraft are indispensable business productivity tools, allowing flexibility, connectivity and efficiency. But they are also on the front line, providing an essential transportation and supply link for those in need around the world."

“Once again, we see that business aviation is a vital tool for companies of all sizes, enabling passengers to use their travel time for more effectively and efficiently than alternatives, while also providing critical lift to smaller communities and areas in need of emergency relief,” NBAA President and CEO Ed Bolen said.

The Harris Poll conducted 202 online interviews of pilots, flight department managers and directors of flight operations or aviation for this survey, with 276 interviews among passengers on business aircraft. Its findings are in line with previous Harris Poll surveys in 1997, 2009 and 2015. Like those examples, the 2018 study was conducted on behalf the No Plane No Gain industry advocacy campaign, co-founded by NBAA and GAMA.

This press release was originally published by GAMA on October 16, 2018.

-

ArticleAviation Industry Urges U.S. Senate Leadership to Pass a Long-Term FAA Reauthorization see more

Washington, DC — The General Aviation Manufacturers Association (GAMA) and 32 other aviation industry organizations today sent a letter to U.S. Senate Majority Leader Mitch McConnell (R-KY) and U.S. Senate Minority Leader Chuck Schumer (D-NY), urging them to have the Senate move expeditiously to consider legislation for a long-term reauthorization of the Federal Aviation Administration (FAA).

“It is essential that the FAA is provided long-term authorization for its activities and programs to maintain and advance the safest, most efficient aerospace system in the world,” the groups, spanning representatives of general aviation, labor, commercial and cargo airlines, drones, manufacturers and more, wrote. “The U.S. aviation sector supports nearly 11 million jobs and contributes $1.6 trillion in economic activity. The aerospace industry needs dependable authority from the FAA and policymakers to continue to provide the highest level of service for aviation customers and meet the needs of the aviation industry and workforce.”

Congress has not enacted a multi-year authorization bill for the FAA since 2012, a bill that expired almost three years ago. Since September 2015, the agency has been working under a series of short-term extensions, including the current measure expiring on September 30, 2018. The U.S. House of Representatives recently passed its version of a long-term reauthorization bill (H.R. 4). The signatories of this letter believe it is imperative for the U.S. Senate to complete its consideration of S. 1405 as soon as possible, to allow adequate time for House and Senate negotiators to reach a final conference agreement by the end of September.

“There is bipartisan support for moving the FAA bill forward now to ensure safety, economic benefits, regulatory reform, and international competitiveness through a long-term reauthorization bill for the FAA,” the groups concluded. “We are eager to assist you in securing consideration of this important legislation and we appreciate your leadership.”

The complete letter is attached.

For additional information, please contact Sarah McCann, GAMA Director of Communications, at +1 (202) 637-1375 or smccann@gama.aero.

This article was originally published by GAMA on August 15, 2018.