Activity

-

NAFA Administrator posted an articlePreowned Single-Engine Helicopter Pricing Continues to Surge in First Half of 2025 see more

TORONTO, Canada, July 16, 2025 – Aero Asset, a global helicopter sales and market intelligence firm, released its 2025 Half Year Heli Market Trends Single-Engine Edition. Backed by Aero Asset’s expertise and proprietary market insight, the report delivers a detailed analysis of the global preowned single-engine helicopter market in the first half of 2025.

The report reveals that retail sales volume dropped 19% year-over-year (YOY) to a four-year low, while median transaction prices rose 19%. Supply for sale continued to climb, up 9% YOY and absorption rate reached a four-year peak Q2 2025.

“We’re seeing a combination of declining sales volume and prices soaring,” said Valerie Pereira, Aero Asset’s Vice President of Market Research. “Despite this market disparity, buyers continue to pursue mission-specific configurations. Notably, demand in the EMS segment grew in the first half of the year, signaling its continued resilience.”

Leveraging transactional data, fleet analysis, and proprietary market tracking tools, Aero Asset’s half year 2025 report provides a detailed view of global sales & supply dynamics, absorption rates, pricing, and liquidity across the single-engine segment. Below highlights reflect key performance indicators shaping the preowned market in the first half of the year:

Market Highlights:

- Retail Sales Volume: 76 units sold S1 2025, totaling $195 million (–19% in units YOY, –2% in value).

- Supply for Sale: 145 units available valued at $361 million (+9% YOY in units, +6% in value).

- Absorption Rate: Increased to 11 months, the highest level since 2021.

Pricing Trends:Pricing continued to climb in the first half of 2025, with median transaction prices rising 19% year-over-year. Utility-configured aircraft were a major contributor to the pricing momentum, with a 31% increase in transaction value YOY. On average, aircraft sold 13% below asking price, reflecting that asking prices remain high and buyers value-conscious.

Regional Performance:The North American market led global activity, accounting for two-thirds of all transactions in the first half of 2025. Despite a 25% YOY decrease in transaction volume, European sales rebounded to second place overall. Sales in Asia Pacific and Latin America dropped sharply, down 43% and 60% respectively in S1 2025.

Liquidity Rankings:Airbus AS350 B3/B3e/H125 and Bell 407/GX/P/I remained the most liquid markets. In contrast, the Leonardo A119K/Ke/Kx reached a four-year performance low with an absorption rate of 2.4 years.

Download 2025 Half Year Heli Market Trends Single-Engine EditionTrusted by operators, financiers, and industry professionals worldwide, Heli Market Trends provides data-driven insight into the global preowned helicopter market. Download the full 2025 Half Year Heli Market Trends Single-Engine Edition at aeroasset.com/report. The report also features a conversation with Monica Mazzei, who recently joined Aero Asset as Senior Sales Director.

###

About Aero Asset Inc.

Aero Asset is an international helicopter trading and market intelligence firm, headquartered in Toronto, Canada. With decades of experience marketing and selling aircraft across the globe, the company has grown into a leading helicopter sales and market intelligence firm offering aircraft remarketing & acquisition services, as well as an array of advisory services.Aero Asset is a member of the Vertical Aviation International, National Aircraft Finance Association, the European Helicopter Association, and the National Business Aviation Association.

For more information about the company, its inventory, or its full scope of services and industry reports, please visit https://aeroasset.com.

Safe Harbor Statement

No representation, guarantee or warranty is given as to the accuracy, completeness or likelihood of achievement or reasonableness of any statements made by or on behalf of Aero Asset. The information contained herein should not be construed as advice to purchase or sell aircraft. Neither Aero Asset nor its owners, directors, officers, employees, agents, independent contractors or other representatives shall be liable for any loss, expense or cost (including without limitation, any consequential or indirect loss) that you incur directly or indirectly as a result of or in connection with the use of data or statements contained herein or otherwise provided by Aero Asset.

Download 2025 Half Year Heli Market Trends Single-Engine Edition

This press release was originally published by Aero Asset on July 16, 2025.

-

NAFA Administrator posted an articleJetcraft releases their latest Market Intelligence Update see more

NAFA member Jetcraft released their Q2 2025 Market Intelligence Update.

A turning point in market momentum

After two years of softening market conditions, early 2025 has brought a notable shift. For the first time since 2022, the share of the business aviation fleet available for sale is declining. This re-tightening of inventory–driven by geopolitical uncertainty and a growing “wait-and-see” attitude among sellers–is already influencing transaction behavior.

Cilck here for more information

This report was originally published by Jetcraft on June 9, 2025.

-

NAFA Administrator posted an articleGlobal Jet Capital Releases Q1 2025 Market Brief see more

NAFA member Global Jet Capital releases their Q1 2025 Market Brief.

The Global Jet Capital Market Brief covers the state of the aviation market for new and pre-owned business jets; including, an overview of overall economic conditions, business jet flight operations, pre-owned and new market conditions, business jet transactions, and changes in aircraft residual values.

The report includes data and perspective on:

- General economic conditions

- Flight operations

- Fleet status

- New and used aircraft market conditions

- Transaction activity (new and used)

- Residual values

- Recent Global Jet Capital transactions

This Market Brief was originally published by Global Jet Capital on May 27, 2025.

-

NAFA Administrator posted an articleAero Asset Report Reveals Rising Preowned Twin-Engine Helicopter Prices Despite Mixed Market Perform see more

DALLAS, TX, March 10, 2025 – Aero Asset, a global helicopter sales and market intelligence firm, kicked off VERTICON 2025 with the release of its 2024 Annual Heli Market Trends Twin-Engine Edition, offering in-depth insights into the evolving preowned twin-engine helicopter market. The report revealed that pricing for preowned twin-engine helicopters held strong last year despite supply and performance shifts across market segments.

“Our research shows a slowdown in 2024 deal volume and a growing supply for sale,” said Valerie Pereira, Vice President of Market Research at Aero Asset. “However, the resilience in transaction prices—an 11% year-over-year increase—highlights the continued demand for quality preowned twin-engine helicopters, despite supply fluctuations.”

Drawing from proprietary market intelligence, Aero Asset’s 2024 Annual Heli Market Trends Twin-Engine Edition provides a detailed analysis of trends shaping the industry. The following are key highlights from the report.

Market Trends

- Retail sales volume of preowned twin-engine helicopters declined by 8% year-over-year (YOY) in 2024.

- Supply for sale increased 14% YOY, while absorption rates rose to 16 months of supply at current trade levels.

Weight Class Performance

- Light twin-engine helicopters: Sales remained steady, but supply surged 33% YOY.

- Medium twin-engine helicopters: Retail sales declined 22%, while supply dropped 15% YOY.

- Heavy twin-engine helicopters: Supply increased 13% YOY, but retail sales hit a five-year low S2 2024.

Average Transaction Prices

- Overall average transaction price (ATP) of preowned twin-engine helicopters was 11% higher YOY.

- Light twin-engine helicopters reached a five-year ATP peak in S2 2024.

- Medium and heavy twin-engine helicopters recorded an 8% YOY price increase.

Regional Shifts

- In 2024, Europe led in retail sales growth, surging 29% YOY.

- North America followed with a 6% YOY increase, accounting for 36% of global transactions, while Europe closely trailed at 32%.

- Supply for sale grew in Europe, Asia Pacific, and Latin America, but declined in other regions.

Liquidity Lineup

- The Airbus EC/H145 was the best-performing preowned twin-engine model in 2024.

- The EC/H135 and Leonardo AW109S/SP also ranked among the strongest contenders.

- The Sikorsky S76D and Airbus EC/H225 markets were the weakest performers.

Deal Pipeline

- At the close of Q4 2024, only 20 twin-engine retail transactions were pending, marking a three-year low.

- The number of transactions in progress was 50% lower Q4 2024 vs. 2023, signaling a possible cooling trend.

If you have questions or would like additional information, please visit the Aero Asset team at their VERTICON booth #5911 at the Kay Bailey Hutchison Convention Center in Dallas. If you are attending VERTICON, make plans to attend Aero Asset’s annual data presentation and press conference on March 10 at 2:00 p.m. CT in room #D222 on Level Two of the Kay Bailey Hutchison Convention Center.

Download the 2024 Annual Heli Market Trends Twin-Engine Edition:

This year’s edition also includes an interview with Jason Kmiecik, President and Owner of HeliValue$, Inc., and publisher of The Official Helicopter Blue Book®, the accepted standard for helicopter resale pricing information.

###

About Aero Asset Inc.

Aero Asset is an international helicopter trading and market intelligence firm, headquartered in Toronto, Canada. With a multilingual team and decades of experience marketing and selling aircraft across the globe, the company has grown into a leading helicopter sales and market intelligence firm offering helicopter market reports, fair market value analysis, remarketing services, and tip-to-tail transaction execution services.

Aero Asset is a member of the Vertical Aviation International, National Aircraft Finance Association, the European Helicopter Association, and the National Business Aviation Association.

For more information about the company, its inventory, or its full scope of services and industry reports, please visit https://aeroasset.com.

Safe Harbor Statement

No representation, guarantee or warranty is given as to the accuracy, completeness or likelihood of achievement or reasonableness of any statements made by or on behalf of Aero Asset. The information contained herein should not be construed as advice to purchase or sell aircraft. Neither Aero Asset nor its owners, directors, officers, employees, agents, independent contractors or other representatives shall be liable for any loss, expense or cost (including without limitation, any consequential or indirect loss) that you incur directly or indirectly as a result of or in connection with the use of data or statements contained herein or otherwise provided by Aero Asset.

-

NAFA Administrator posted an articleGeneral Aviation Provides Robust Contribution to U.S. Economy see more

Study Reveals General Aviation Supports Over 1.3 Million Jobs and $339 Billion in Economic Output

WASHINGTON D.C., – February 19, 2025 - An updated study, released today, details the robust contributions of general aviation to the U.S. economy. A group of eight general aviation associations welcomed the update, conducted by PwC US Tax LLP, which determined that general aviation supports a total 1,330,200 jobs and a total of $339.2 billion in total economic output in the U.S.

The General Aviation Manufacturers Association (GAMA), Aircraft Electronics Association (AEA), Aircraft Owners and Pilots Association (AOPA), Experimental Aircraft Association (EAA), National Association of State Aviation Officials (NASAO), National Air Transportation Association (NATA), National Business Aviation Association (NBAA) and Vertical Aviation International (VAI) sponsored the study. Leaders of the associations were encouraged by the study’s depiction of the significant contribution that the general aviation industry has on the U.S. economy.

“We are proud to report that despite challenges that have plagued the entire aerospace industry since the beginning of the pandemic, the segment of the U.S. economy affected by general aviation grew over 150,000 jobs and an additional $92 billion in annual economic impact since last reported in 2020,” said Pete Bunce, GAMA President and CEO. “This growth takes place at a time when the importance of the societal benefits that general aviation brings to humankind around the globe cannot be overstated. From aerial firefighting, medical airlift, natural disaster response, law enforcement, agriculture protection, through drone vaccine delivery, general aviation is saving lives while our business aviation segment creates the corporate connectivity to allow companies the competitive advantage needed to create more jobs and promote economic growth. General aviation is the technology incubator for civil aviation – our evolution is spurring more sustainable propulsion systems, safety enhancing avionics capabilities, advanced material manufacturing, and improved maintenance, training and support. These amazing innovations all serve as a testament to the strength of our industry being propelled by the hardworking teams that are engineering, building, maintaining and servicing the aircraft of today and tomorrow.”

“This third report in just over a decade is further evidence that general aviation is a catalyst for local economies, a lifeline for rural communities, and essential to the makeup of American commerce,” said Mike Adamson, AEA president and CEO. “The economic contributions of this industry are profound, and the possibilities for the future are promising. As an industry dedicated to powering safer, more efficient flight, we are creating more high-tech and high-wage careers, innovating technologies, providing essential services and inspiring the next generation.”

See full report and PwC study here

This press release was originally published by GAMA on February 19, 2025.

-

NAFA Administrator posted an articleGAMA Releases 2024 Aircraft Shipment and Billing Report see more

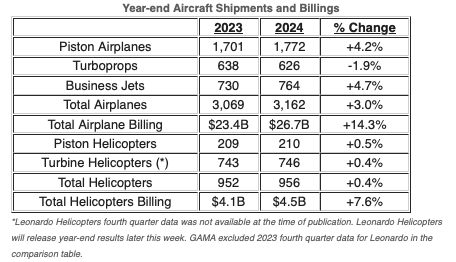

NAFA member, General Aviation Manufacturers Association (GAMA) released its' 2024 Aircraft Shipment and Billing Report.

WASHINGTON, D.C. – February, 19, 2025 - Today, the General Aviation Manufacturers Association (GAMA) released the 2024 General Aviation Aircraft Shipment and Billing Report during its annual State of the Industry Press Conference. Overall, when compared to 2023, nearly all aircraft segments saw increases in shipments and preliminary aircraft deliveries were valued at $31.2 billion, an increase of 13.3%.

“As we report on the strength of the general aviation manufacturing industry over the past year, it is notable that for the first time in a decade our companies again exceeded $30 billion in annual billings and for the second year in a row, we shipped more than 4,000 units. This strong performance provides great momentum into 2025, but it is essential that policymakers and regulators on both sides of the Atlantic recognize that for continued growth, they must work with industry on policy issues such as taxes, trade, regulations and supply chain. General aviation is at the forefront of advancing technology that makes flying safer and more sustainable, while providing efficient and reliable global economic connectivity, and air accessibility to rural and small communities that lack commercial airline services. It would be a travesty to see any of this progress halted due to policy decisions that could have unintended consequences for an industry that contributes so much.” said Pete Bunce, GAMA President and CEO.

Airplane shipments in 2024, when compared to 2023, saw piston airplanes increase 4.2% with 1,772 units, turboprops decline slightly by 1.9% with 626 units, and business jets increase 4.7% with 764 units. The value of airplane deliveries for 2024 was $26.7 billion, an increase of 14.3%.

Helicopter shipments in 2024, when compared to 2023, saw piston helicopters in-line with 210 units, and preliminary turbine helicopters in-line with 746 units, an increase of one and three units respectively. The preliminary value of helicopter deliveries for 2024 was $4.5 billion, an increase of approximately 7.6%.

Click here for GAMA's complete 2024 year-end report.

This report was originally published by GAMA on February 19, 2025.

-

NAFA Administrator posted an articlejetAVIVA shares their 2025 Market Forecast see more

NAFA member jetAVIVA shares their 2025 Market Forecast.

One year ago, many wondered how the markets would fare heading into a volatile election season. But a data point shared around mid-2024 put our minds at ease: historically, election years’ sales volumes align closely with those of the preceding and succeeding years. While December data is still being finalized, preliminary reports suggest that pre-owned transactions in 2024 will likely show a year-over-year change within a single-digit percentage range, effectively indicating a stable market compared to 2023. Optimism and activity have increased post-election, and if market trends continue, this signals another promising year for the business aviation market.

There are a few variables on the board worth keeping an eye on. There’s buzzing chatter about a potential return of 100% Bonus Depreciation. While this would undoubtedly be a boon to the industry, the timing and scope of its impact remain uncertain. Additionally, December’s strong jobs report raised some concerns about inflation, while recent CPI and PPI data pointed to easing price pressures but left the future of interest rates uncertain. While rate adjustments remain on the table, they are unlikely to significantly influence deal behavior this year.

Looking more closely at the pre-owned business jet market, it remains robust. Inventory levels rose consistently throughout 2024 but generally stayed below 10% of the fleet for sale. High-pedigree aircraft continue to trade quickly, and pricing—while steadily normalizing to standard depreciation cycles—remains strong for desirable models.

December saw nearly double the number of closings compared to preceding months, with some deals still finalizing as we speak. Was this a typical year-end rush, or did pent-up demand unlock post-election? The first quarter of 2025 will likely provide the answer. At jetAVIVA, we’re off to a roaring start. Our forecast for the first quarter is on pace to be the best in my tenure with the firm, thanks largely to business initiated after November 5th.

This article was originally published by jetAVIVA on January 20, 2025.

-

NAFA Administrator posted an articleGlobal Jet Capital releases latest Business Aviation Market Brief see more

NAFA member, Global Jet Capital, released its latest Business Aviation Market Brief.

Q4 2024 marked a period of stability for the business jet market following unprecedented utilization and demand in the aftermath of the COVID-19 pandemic. The market continued to demonstrate strength and resilience, evidenced by an increase in flight operations, continued strong backlogs, and a high volume of transactions. Inventory gradually increased throughout 2024, but declined in Q4 compared to Q3, and remained below pre-COVID norms. Additionally, the macroeconomic environment experienced steady growth and declining inflation levels, despite geopolitical uncertainty. Overall, the industry is poised for a strong start to 2025.

This Market Brief was originally published by Global Jet Capital on February 19, 2025.

-

NAFA Administrator posted an articleSOLJETS 2025 Private Jet Market Outlook and Projections see more

The COVID-19 pandemic reshaped numerous luxury sectors, none more significantly than private aviation. As global travel patterns shifted dramatically, private jets became not just a symbol of wealth, but a crucial tool for safety, flexibility, and convenience. Now, as we approach 2025, understanding the trajectory of the private jet market is vital for industry stakeholders, from manufacturers and financial institutions to private aviation enthusiasts. Let’s take a look at what’s ahead in 2025.

Surge in Demand During the Pandemic

The pandemic marked a watershed moment for the private aviation industry. As travel restrictions and safety concerns around crowded commercial flights intensified, many affluent individuals turned to private jets. This shift was driven by a need for both security and flexibility in travel, as private jets offered the ability to avoid crowded airports and adhere to personal safety protocols.

According to Global Jet Capital, demand for private jets surged by over 20% during the height of the pandemic, with North America—accounting for 64% of global business jet deliveries—seeing the most significant growth. The North American market, in particular, experienced a dramatic increase in private flight hours, as well as a rise in the number of first-time buyers entering the market.

This surge in demand was not only reflected in the number of private jets in the sky but also in the steep rise in the values of both new and pre-owned aircraft. For example, some business jets saw an appreciation of 10-20% in value, a rarity in an industry that typically sees depreciation over time.

This report was originally published by SOLJETS on February 2, 2025.

-

NAFA Administrator posted an articleAero Asset’s Heli Market Trends 2024 Annual Report: Single-Engine Edition see more

Single-Engine Helicopter Market Shows Uncertainty: Sales Stable but Supply Surges 30% in 2024

TORONTO, Canada, January 28, 2025 – Aero Asset, a global helicopter sales and market intelligence firm, has launched its Heli Market Trends 2024 Annual Report: Single-Engine edition. This report delivers an authoritative analysis of the global preowned market for single-engine helicopters featuring Aero Asset’s proprietary market intelligence and expert insight.

“Retail sales of single-engine helicopters remained stable in 2024, while supply for sale reached its highest point in four years, Q4 last year,” said Valerie Pereira, Aero Asset’s Vice President of Market Research.

Aero Asset’s analysis of last year’s data shows that retail sales remained stable in 2024 versus 2023 year over year (YOY). The supply of single-engine helicopters for sale ended 30% higher YOY reaching a four-year peak Q4 2024. Absorption rate increased to 12 months of supply at current trade levels.

Regional Market Performance

In terms of transaction volume, both North America and Asia Pacific entered a bull market while sales in Europe slowed down. North American buyers were the most active worldwide, accounting for two-thirds of all single-engine helicopter transactions in 2024. APAC buyers were second most active while Europe dropped to fourth place in this regional transaction volume ranking.

Europe saw a 26% increase in single-engine helicopter supply for sale, culminating at the end of Q4 2024 to 35% of the global stock. Supply for sale in remaining regions: APAC (25%, +90%), North America (23%, +36%), Latin America (10%, -25%), rest of the world (7%, +22%).

Pricing & Liquidity

Aero Asset’s research shows that average transaction price increased 4% and average days on market increased 2% YOY. The most liquid preowned market in 2024 was Airbus AS350 B3/B3e/H125, followed by Bell 407/GX/P/I. The least liquid preowned market in 2024 was Airbus EC130B4/H130T2, with an absorption rate of 1.5 years.

Heli Market Trends 2024 Annual Report Available

To access Aero Asset’s Heli Market Trends 2024 Annual Report: Single-Engine Edition, visit: aeroasset.com/report. This year’s report includes a conversation with Christopher Lee, President of the Specialty Finance Group's Aviation Finance Division at 1st Source Bank.

###

About Aero Asset Inc.

Aero Asset is an international helicopter trading and market intelligence firm, headquartered in Toronto, Canada. With a multilingual team and decades of experience marketing and selling aircraft across the globe, the company has grown into a leading helicopter sales and market intelligence firm offering helicopter market reports, fair market value analysis, remarketing services, and tip-to-tail transaction execution services.

Aero Asset is a member of the Vertical Aviation International, the Association of Air Medical Services, National Aircraft Finance Association, the European Helicopter Association, and the National Business Aviation Association.

For more information about the company, its inventory, or its full scope of services and industry reports, please visit https://aeroasset.com.

Safe Harbor Statement

No representation, guarantee or warranty is given as to the accuracy, completeness or likelihood of achievement or reasonableness of any statements made by or on behalf of Aero Asset. The information contained herein should not be construed as advice to purchase or sell aircraft. Neither Aero Asset nor its owners, directors, officers, employees, agents, independent contractors or other representatives shall be liable for any loss, expense or cost (including without limitation, any consequential or indirect loss) that you incur directly or indirectly as a result of or in connection with the use of data or statements contained herein or otherwise provided by Aero Asset.

-

NAFA Administrator posted an articleGlobal Jet Capital releases Q3 2024 Business Aviation Market Brief. see more

Global Jet Capital releases Q3 2024 Business Aviation Market Brief.

The business jet market continued to stabilize in Q3 2024 after experiencing unprecedented utilization and demand in the aftermath of the COVID-19 pandemic. Year-over-year, there was a decrease in flight operations, an increase in inventory levels, and a decline in OEM order intake. Despite this shift, the market continues to show strength and resilience. Driven by strong new deliveries, transactions leveled off following declines in 2023. OEMs reported strong backlogs. Flight operations stayed above pre-pandemic levels, and availability — particularly for newer, more desirable aircraft — remained low. Additionally, the macroeconomic environment experienced steady growth and declining inflation levels, despite ongoing headwinds. Overall, the industry is well-prepared to handle any potential market disruptions.

This Market Brief was originally published by Global Jet Capital on November 19, 2024.

-

NAFA Administrator posted an articlePre-Owned Business Aircraft Market: 2025 Outlook see more

AvBuyer's Chris Kjelgaard asks industry experts what conditions they reckon will prevail in the market for pre-owned business aircraft in 2025.

Barring a major geopolitical event or environmental calamity, 2025 should prove to be a year of price stability and healthy trading levels for the younger examples of the world’s fleet of pre-owned business aircraft. Such is the view of four senior aircraft traders...

But the outlook isn’t anywhere near as rosy for business aircraft which have been in service for 20-plus years as the pre-owned market settles back to what insiders consider a “normal” state of buying and selling activity.

The aircraft brokers see the market in North America, and particularly the US, continuing to dominate pre-owned aircraft for sale activity. And not only will activity in the US domestic market continue at a high level, but internationally the US will be a net accepter of pre-owned business aircraft from around the globe.

The hungry US market is expected to particularly look to Europe for pre-owned jets and turboprops, partially because European Business Aviation is under an increasingly intense spotlight from the continent’s environmental organizations and governments.

While much of that scrutiny is uninformed and unfair, the pressure is anticipated to continue to result in used aircraft leaving the European fleet to make their way elsewhere – particularly to the US (for smaller and larger aircraft alike) and to the Middle East and Asia (for large business jets).

Current & Near-Future Used Aircraft Market Conditions

Tony Theis, Vice President of Sales, Acquisitions and Consulting for Central Business Jets, notes the market for used business aircraft has become much more stable in 2024, with the buying frenzy prevalent during the peak of the COVID-19 pandemic calming.

“What Central Business Jets is seeing is that prices have really come back to a healthy stabilization,” he adds. “They have come down about 10% across the board from the highs of 2021 to 2023.”

In the globally dominant US market, growth has been very modest in 2024, because the US’s GDP has stagnated and could even end the year down. “The thing we do know that affects the [used] aircraft market is not the stock market, but the GDP of the economy,” Theis continues. “We see growth when we get over the 2% range” in GDP growth.

Because the US GDP is not growing at a strong clip, Theis reckons "we are not seeing 4-6% growth” in the aircraft market as a result. Additionally, he says “we’re seeing discounts because aircraft...were too highly priced” during the pandemic-led trading bubble.

That said, the market “is still up quite a bit from pre-COVID levels and we’re still seeing very healthy numbers” of inquiries for Central Business Jets’ listings of aircraft for sale, he says, revealing his company received about 30 inquiries for a Bombardier Challenger 300 it listed the previous week.

While most were from individuals or companies who were “just curious” about the aircraft, five or six were from those who were “really thinking of upgrading” to a younger or bigger aircraft.

Overall, he adds, the healthy state of the used-aircraft market is benefiting from the fact that the “OEM backlogs [of new aircraft on order] are stable and really healthy – the OEM market drives the used market”.

Business Aircraft OEMs Hold Fire

According to Johnny Foster, President & CEO of OGARAJETS, today business aircraft manufacturers are all boasting orderbook backlogs of 18-24 months at current production levels.

This article was originally published by AvBuyer on November 5, 2024.

-

NAFA Administrator posted an articleThe Latest US Business Aviation Market Trends see more

Gerrard Cowan speaks to a selection of leading Business Aviation professionals to discover more about the current US market...

While the US business aircraft market experienced a post-Covid boom, there have been signs of softer demand in recent months. Nevertheless, although the sector is adapting to new economic and geopolitical realities, industry experts retain strong optimism looking forward.

Among the factors impacting today’s market, Wen Chongjian, Vice President, Aircraft Sales at Leviate Air Group, says the US business aircraft market in 2024 faces a unique set of challenges and opportunities, driven by political uncertainty, economic factors, and shifting demand dynamics.

“Compared to one to two years ago, demand in the pre-owned market has softened somewhat, with more buyers taking a cautious approach due to heightened uncertainty and higher interest rates,” Chongjian notes.

“Key geopolitical events, such as the ongoing war in Ukraine, have added complexity by impacting fuel costs and global supply chains, indirectly influencing aircraft ownership decisions.”

Chongjian reckons the more immediate drivers of demand in the US market are domestic political uncertainty tied to the Presidential election in November, as well as broader economic conditions reflected by inflation and interest rates.

There has been a gradual increase in inventory across most aircraft markets, which is impacting pricing strategies, Chongjian notes. The overall percentage of fleet for sale is still below 10%, which typically indicates a seller’s market, but there are signs of transition in some segments, he says.

“Older models with higher operating costs, for instance, are increasingly entering a buyer’s market due to reduced demand, and certain markets have already dived deep into the buyer’s market with nearly 18% of the fleet for sale,” he qualifies.

“The current interest rate at over 7% for aircraft financing is making aircraft ownership more expensive, especially for those models that are less fuel-efficient or come with higher maintenance costs.”

This article was originally published by AvBuyer on October 3, 2024.

-

NAFA Administrator posted an articleAero Asset released its 2024 Half Year Heli Market Trends Twin-Engine edition. see more

TORONTO, Canada, September 19, 2024 – Aero Asset released its 2024 Half Year Heli Market Trends Twin-Engine edition. Aero Asset leverages proprietary market intelligence to deliver a comprehensive analysis of the market, allowing readers to navigate the shifting dynamics of the preowned twin-engine helicopter market.

“Our analysis shows a 30% year-over-year decrease in retail sales volume of preowned twin-engine helicopters in the first half of 2024, and a 26% increase in supply for sale,” said Valerie Pereira, Vice President of Market Research. Additionally, Pereira explained the absorption rate had increased to 18 months of supply at current trade levels.

Pricing

Despite the lower sales volume, average preowned trading prices have reached a five-year peak across all twin-engine asset classes, with the biggest average transaction price increases in the light (+21%) and medium twin-engine helicopter markets (+14%) year over year (YOY).

Weight Class Performance

Retail sales declined across all weight classes YOY. The medium twin market saw the biggest drop in retail sales (-46% YOY), followed by heavies (-25% YOY), and light twin-engine helicopters (-14% YOY). Supply for sale of light twin-engine helicopters reached one of its highest levels; conversely, medium and heavy twin market supply for sale reached their lowest point in five years.

Regions

In the first half of 2024, Europe was the only region to buck the trend and see an increase in preowned retail transactions (+5% YOY). Asia Pacific experienced the biggest regional drop in retail sales volume (-73% YOY). Supply in North America and Europe increased by 5% and 35% respectively YOY. These regions represented 62% of the total supply and accounted for two-thirds of total retail sales in the first half of 2024.

Liquidity

The best performing preowned twin-engine market during the first six months of 2024 was the Airbus EC/H145, followed by the Airbus EC/H135, and the Leonardo AW139. The slowest performing preowned twin markets were the Airbus EC/H155 and Sikorsky S76D markets, with absorption rates over three years.

Download 2024 Half Year Heli Market Trends Twin-Engine Edition

Heli Market Trends reports have become a trusted source of insight and analysis covering the global preowned helicopter market. Visit aeroasset.com/report to download the latest report with all its data and valuable analysis. This report includes a conversation with Sarah Fairweather, Partner and Head of Talent at Jaffa & Co.

###

About Aero Asset Inc.

Aero Asset is an international helicopter trading and market intelligence firm, headquartered in Toronto, Canada. With a multicultural team and decades of experience marketing and selling aircraft across the globe, the company has grown into a world-leading helicopter sales and market intelligence firm.

Aero Asset is a member of the Helicopter Association International, the Association of Air Medical Services, the National Aircraft Finance Association, the European Helicopter Association, and the National Business Aviation Association.

For more information about the company, its inventory for sale, or its full scope of services and industry reports, please visit https://aeroasset.com.

Safe Harbor Statement

No representation, guarantee, or warranty is given as to the accuracy, completeness or likelihood of achievement or reasonableness of any statements made by or on behalf of Aero Asset. The information contained herein should not be construed as advice to purchase or sell aircraft. Neither Aero Asset nor its owners, directors, officers, employees, agents, independent contractors or other representatives shall be liable for any loss, expense or cost (including without limitation, any consequential or indirect loss) that you incur directly or indirectly as a result of or in connection with the use of data or statements contained herein or otherwise provided by Aero Asset.

This Press Release was originally published by Aero Asset on September 19, 2024.

-

NAFA Administrator posted an articleGAMA Releases Second Quarter 2024 Aircraft Shipment and Billing Report see more

WASHINGTON, D.C. – Today, the General Aviation Manufacturers Association (GAMA) published the Second Quarter 2024 General Aviation Aircraft Shipment and Billing Report. The general aviation aircraft manufacturing industry’s results for the first six months of 2024, when compared to the same period in 2023, show increased deliveries across the piston airplane, business jet and piston helicopter segments along with an increase in the overall value of aircraft shipments.

“Through the first half of 2024, we continue to see robust demand for new aircraft, as indicated by the impressive backlogs and plans for facility expansion by many of our OEMs. Our constraints continue to be ongoing supply chain and workforce recapitalization issues, which are routinely compounded by unacceptable turn times in terms of responsiveness and lack of decision making by the FAA specialists on such things as issue papers, certification plans and regular correspondence. Our industry is the incubator of safety enhancing and aviation sustainability technology, which in-turn serves as a catalyst for economic growth and exemplary employment for millions around the globe. It is vital that our regulators continue to improve effectiveness and efficiency of certification and validation processes, appropriately apply the safety continuum across the spectrum of general aviation products and respond to applicants in a timely manner. For the continued vitality of our industry and to facilitate all the great innovations that are taking place, it is imperative that we tackle these ongoing challenges,” said Pete Bunce, GAMA President and CEO.

This report was originally published by GAMA on September 9, 2024.