NAFA member, Aero Asset, recently released their Heli Market Trends Half Year 2023 Report Single Engine Edition.

Key Findings

–

TRANSACTION VOLUME DOWN, SUPPLY FOR SALE RISES

• Retail sales decreased 60% S1 2023 vs same period 2022 (YOY).

• Supply for sale ended 70% higher year over year (YOY).

• Absorption rate increased to 8.5 months of supply at current trade levels.

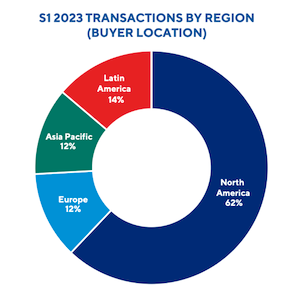

ROBUST DEMAND FOR SINGLES IN NORTH AMERICA

• North American buyers accounted for 2/3rd of all transactions S1 2023.

• Retail transactions to Europe dropped 75% YOY.

• Europe & North America account for 2/3rd of the worldwide supply for sale.

PREOWNED PRICING STRONG AGAINST FIRM OEM LEAD TIMES

• Average asking price increased 11% YOY, buoyed by arrival of low time helicopters on the market.

• Average transaction price increased 23% YOY.

• Average days on market dropped 46% YOY.

LIQUIDITY LINEUP

• The most liquid preowned market during the 1st half of 2023 was the Bell 407/GX/P/I followed by the Airbus AS350 B3/B3e/H125, and the Airbus EC130 B4/H130.

• The least liquid preowned market during the 1st half of 2023 was the Leonardo AW119K/Ke/Kx, with an absorption rate of 14 months.

Download the full Heli Market Trends reports here:

https://www.aeroasset.com/en/report-download/S12023-Singles