NAFA member, AeroAsset, shares their Heli Market Trends 2022 Annual Reports.

Single Engine Edition

Key Findings

–

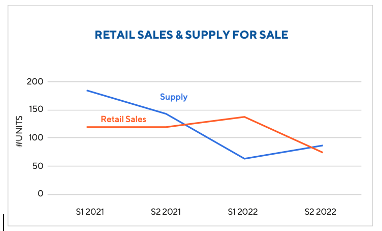

TRANSACTION VOLUME DOWN, SUPPLY DECREASE SLOWS

· Retail sales decreased 12% 2022 vs 2021 (YOY)

· Supply for sale declined 40% year over year (YOY) but rose in the last semester of 2022

· Absorption rate decreased 30% YOY, to 5 months of supply at current trade levels

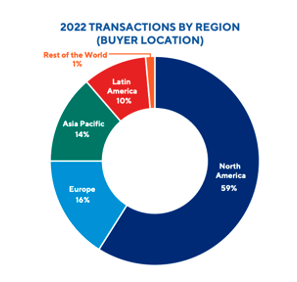

ROBUST DEMAND FOR SINGLES IN NORTH AMERICA

· North American buyers accounted for 2/3rd of all transactions in 2022

· Retail transactions to Europe dropped 40% YOY

· North American supply trippled Q4 22 vs Q2 22

MARKET PERFORMANCE BY CONFIGURATION

· VIP singles accounted for 60% of all transactions in 2022

· EMS supply remains at all time low

· Utility supply for sale dropped 30% YOY

LIQUIDITY LINEUP

· The most liquid preowned market in 2022 was the Airbus AS350 B3/B3e/H125, followed by the Bell 407/GX/P/I and the Airbus EC130 B4/H130. All three models boast 5 months of supply at 2022 trade levels

· The least liquid market, the Leonardo AW119, ranked last with a nonetheless strong absorption rate of 10 months

Twin Engine Edition

Key Findings

–

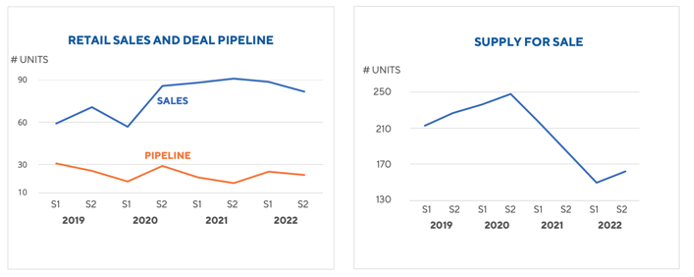

TRANSACTIONS DOWN SLIGHTLY, SUPPLY DROP SLOWS

· Retail sales volume decreased 4% 2022 vs. 2021 (YOY).

· Supply for sale declined 11% year over year (YOY).

· Absorption rate at lowest point in 4 years.

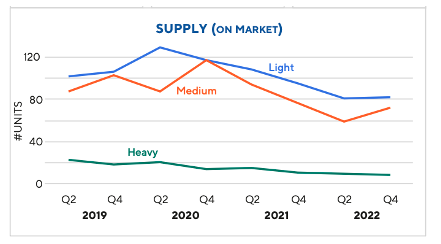

WEIGHT CLASS PERFORMANCE

· Supply for sale continued to decrease in all asset classes through 2022.

· Medium & heavy twin engine retail sales were stable YOY.

· Light twin retail sales declined 10% over same period.

MARKET PERFORMANCE BY CONFIGURATION

· VIP singles accounted for 60% of all transactions in 2022

· EMS supply remains at all time low

· Utility supply for sale dropped 30% YOY

REGIONS & YOM

· North America & Europe accounted for 73% of sales in 2022.

· Europe saw a 20% decrease in transaction volume YOY.

· Sales of 20 yr+ aircraft experienced a strong resurgence YOY.

LIQUIDITY LINEUP

· The best performing preowned twin engine market in 2022 was the Airbus EC/H135, followed by the EC/H145 and the Sikorsky S76C+/C++.

· The worst performing preowned twin markets were the Leonardo AW169 and Sikorsky S76D markets, with no retail sales last year.

· The biggest drop in the lineup was the Bell 429, ranked #2 in 2021 and 10th in 2022.

Full Heli Market Trends reports available at:

Single engine edition https://www.aeroasset.com/en/report-download/2022-Singles

Twin engine edition https://www.aeroasset.com/en/report-download/2022-Twins

These reports were originally published by AeroAsset.