It is difficult, if not impossible, to isolate the exact impact of the new tax bill on aircraft values. There are many concurrent factors that may have an impact on aircraft values, e.g. the economy, regulatory environment and inventory, to name a few. However, we can observe what has been going on in the market since the enactment of, “Tax Cuts and Jobs Act of 2017” (Pub.L.115-97).

How was the pre-owned business aviation market doing before the tax changes?

Excessive enthusiasm with the economy before the subprime crisis was certainly a factor in manufacturers flooding the market with new aircraft. Since the crisis, OEMs reduced the general production but the number of new models has increased. We also have new competitors such as Honda and Pilatus entering the business jet market. The accumulated oversupply is still present in the pre-owned aircraft market. These factors have driven down prices for the pre-owned market, permitting buyers to acquire quality aircraft at a considerably lower price.

This tendency may change given the new tax law. There is already some information about changes in aircraft values, but before we look at that, we want to summarize the tax changes affecting the industry.

What are the tax changes that will have an impact in business aviation?

As reported by the Congressional Budget Office (CBO), high net wealth individuals, pass-through entities and corporations should benefit immediately. While the current number of tax brackets has been retained, each has been reduced, and for those operating an entity with pass-through income, there is a new 20 percent deduction for business income.

For aircraft owners, the savings under the new law are even better. The current bonus depreciation has been amended to provide for 100 percent expensing of the cost of new and pre-owned aircraft (up from 50 percent) acquired and placed in service, provided it is the taxpayer’s first use of the aircraft. Previously, bonus depreciation was only available on new equipment purchases.

Unfortunately, for those who previously used Rev. Code §1031 ‘like-kind’ exchanges (usually for upgrading into larger or longer range aircraft) taxpayers will no longer have the ability to defer taxable gains on the sale of aircraft. In theory, the enhanced depreciation discussed above should offset the repeal of like-kind exchanges for aircraft.

Additionally, changes have been made to travel expense deductions and the Federal Transportation Excise Tax (FET) has finally been clarified (owner flights on managed aircraft are not subject to FET but are subject to non-commercial fuel tax).

Note, for those using aircraft for both business and pleasure, please ensure you speak with your CPA about maximizing the first-year bonus depreciation to ensure non-business guests do not result in disallowances.

What is going on with aircraft values in 2018?

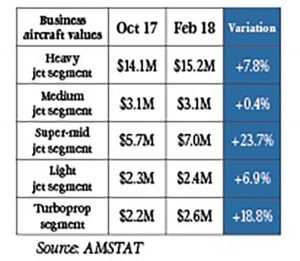

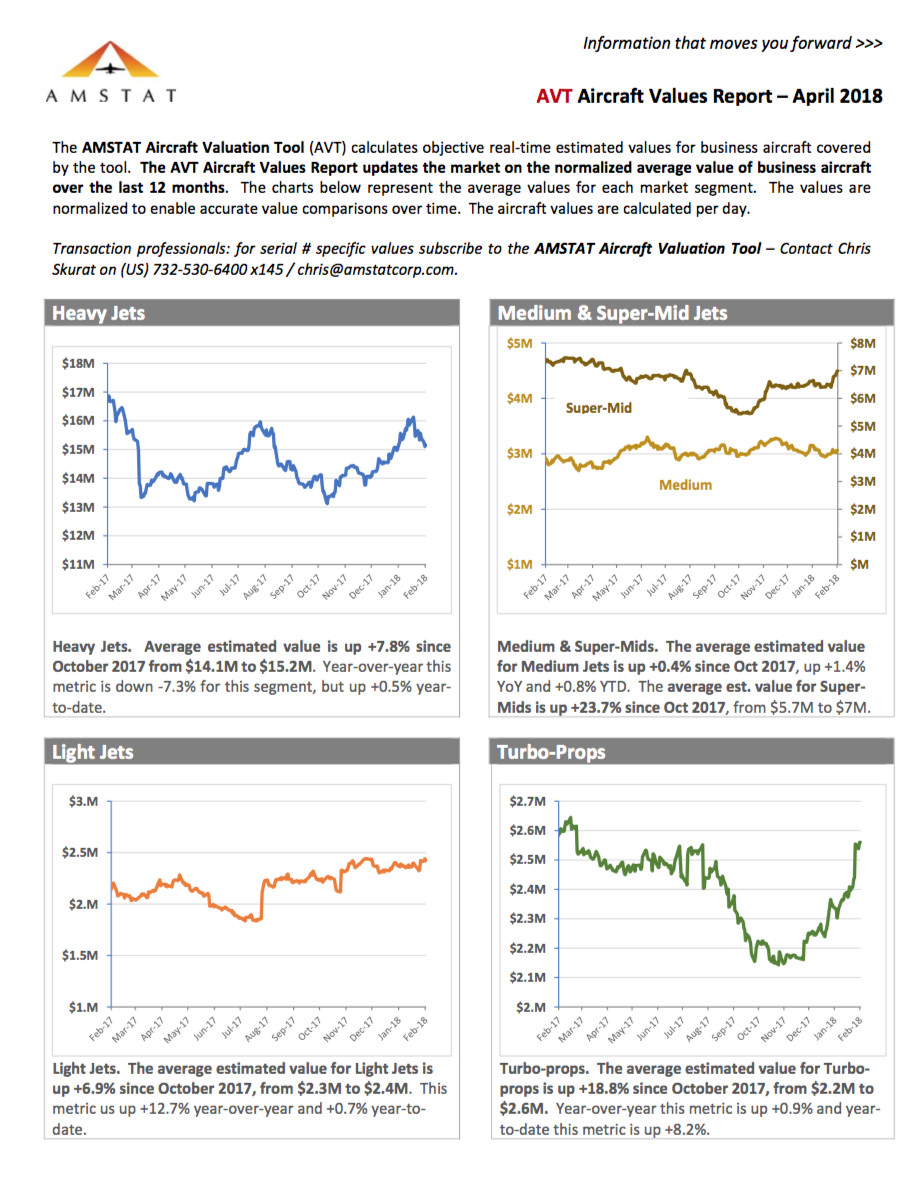

AMSTAT, Aircraft Valuation Tool Report, released in early April 2018, indicates a recent uptick in business aircraft values. According to this re–port, the average estimated values for four of the five major business aircraft segments have risen since the start of Q4 2017.

According to Andrew Young, AMSTAT General Manager, “the increase in estimated values reflects recent increases in market demand and a tightening market with fewer options for buyers.”

The National Aircraft Resale Association (NARA) believes that tax reform is driving aircraft values.

“While political and economic developments around the world can influence the market, now is a great time to buy an aircraft before prices increase,” said NARA Chairman, Brian Proctor. He notes that used aircraft in excellent condition are selling at a faster pace than in years past.

“Our NARA-certified brokers have recognized a change in the marketplace just in the first few months of 2018 since the U.S. tax reform was enacted,” Proctor said. “The market is generating more activity and demand and that is likely to increase as the economy continues to heat up, interest rates rise, and most indicators point to a general economic upturn.”

What is the tendency for the rest of 2018?

The 100 percent expensing rule is an excellent incentive for aircraft owners to step up to a high-quality aircraft. Also, the decrease in the federal income tax rate should be a good incentive for companies and wealthy individuals to buy an aircraft for the first time because they can redirect money savings from taxes to buy an aircraft.

If buyers take advantage of the new tax benefits during the rest of the year by accelerating the purchase of pre-owned aircraft, very soon aircraft will start selling faster and the oversupply should start decreasing. As a consequence, pre-owned aircraft values should rise slowly in 2018 (given all other factors affecting aircraft values remain stable).