Activity

-

ArticleGAMA Publishes 2019 Second Quarter Aircraft Shipment Data see more

NAFA member, Pete Bunce, General Aviation Manufacturers Association's (GAMA) President and CEO, releases Second Quarter Aircraft Shipment Report.

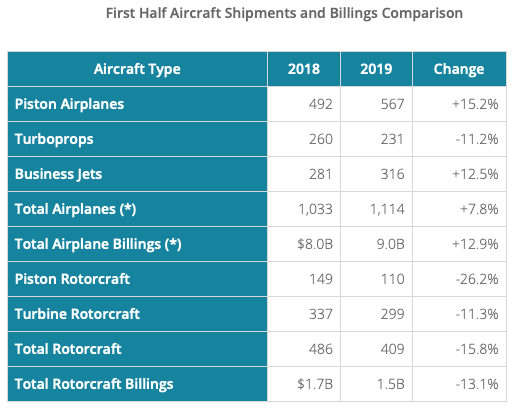

Washington, DC — The General Aviation Manufacturers Association (GAMA) today published a mid-year industry update with the release of preliminary second quarter 2019 aircraft shipment and billings data. Piston and business jet deliveries increased through the first six months of 2019 compared to the same time period in 2018, while turboprop airplane and rotorcraft shipments were lower.

“While the year-to-date aircraft shipments are mixed, this should not obscure the outlook for a bright future for general aviation. Our mid-year report shows new aircraft reaching entry into service milestones with additional models expected to enter into service before the end of 2019,” said GAMA’s President & CEO, Pete Bunce. “Our members remain focused on bringing safety enhancing new technology to the general aviation fleet and upgrading aircraft to meet fast approaching global mandates for Automatic Dependent Surveillance-Broadcast (ADS-B) and datalink communications. Additionally, our industry’s continued emphasis on developing airframes, engines, and avionics that improve fuel efficiency, our aggressive pursuit of hybrid and electrically propelled air vehicles, and promotion of the build out of the Sustainable Aviation Fuel infrastructure, should make us all proud of our collective commitment to environmental sustainability.”

The piston market continued to lead the increase in deliveries at 567 units, up 15.2% from the same period in 2018. Business jet shipments increased by 12.5% in the first six months of 2019 to 316 airplanes delivered. Turboprop airplanes, however, declined in deliveries from 260 to 231 units from the same reporting companies. The value of airplane deliveries through the first six months of 2019 was $9.0 billion, an increase of approximately 12.9%.

Rotorcraft deliveries slowed in the first six months of 2019. Piston rotorcraft shipments declined from 149 units to 110 units. The industry delivered 299 turbine rotorcraft, a reduction by 11.3% compared to 2018. The value of rotorcraft shipments was $1.5 billion, a decline of approximately 13.1%.

Note: Second quarter shipment data was not available from three airplane manufacturers at the time of publication. GAMA will update the report online when the data has been released by the companies. The above comparison table does not include second quarter 2018 data from these three manufacturers.

This press release was originally published by GAMA on August 12, 2019.

-

ArticleNextGen is on the way. What will happen to your lease or loan if you do not upgrade before Jan 2020 see more

by Tony Kioussis with Asset Insight, Inc., and Dave Labrozzi with Global Jet Capital

The mandate for NextGen upgrades is now just two years off, with absolutely no indication from the FAA that it will be extending the January 2020 deadlines.

However, knowing what’s required, and when, doesn’t always translate into action. For those who’ve been procrastinating, the time to get your aircraft into compliance – whether you own or lease it – is right now.

Future Air Navigation System (FANS1/A+) and Automatic Dependent Surveillance Broadcast (ADS-B) systems are the two key NextGen technologies necessary to keep your aircraft, and your business, flying.

An understanding of the benefits of these upgrades to your business asset – and the consequences of noncompliance – may help you better appreciate the need for prompt action.

FANS1/A+ technologies create a direct air-ground datalink, enabling digital transmissions of short messages between pilots and operators. The mandate has expanded to include more tracks and airspaces, the last of these on January 30, 2020.

Without FANS1/A+ by this point, you won’t be making any transoceanic flights.

ADS-B (Out) notably improves safety with increased situational awareness, automatically transmitting positional information, and providing more surveillance coverage. By January 1, 2020, should you plan to fly above 10,000 feet, in FAA-designated Class A, B, or C airspace, which includes nearly every large and mid-sized, and many smaller, U.S. airports, your aircraft must be equipped with ADS-B (Out) – or it will be grounded.

While the ability to broadcast (out) is required, the ability to receive (in) is a value-added option. With the many benefits of ADS-B (In), including the traffic, weather, and aeronautical information obtained, most owners are choosing that option as well.

In fact, sometimes it’s this type of option that leads business owners to lease, instead of buy, their aircraft. The ability to get the latest technology, make adjustments based on evolving business needs, and reduce the risk of investing significant capital or being tied to a title all make leasing worthwhile.

However, whether you own or lease the aircraft, missing the upgrade deadlines will have an impact on where you fly, or if you do at all.

While it’s clear what costs a non-compliant owner would accrue – increased expenses in the form of storage fees and calendar-based maintenance, loss of revenue or even opportunity, as well as the cost of securing charter or another form of alternate lift – a lessee faces additional issues.

Consider, for example, an operating lease, one of the most commonly used tools to finance a costly aviation asset. In this arrangement, the lessor retains ownership, and with it, the residual value risk. The lessee, however, has full use of the aircraft for a specific term while fulfilling all lease, insurance, maintenance, and (almost always) operational obligations.

These operational obligations include FAA regulations, in this case, the NextGen upgrade requirements. Failing to meet the deadlines is a violation of lease terms, and the lessor then can – and most assuredly will – call in the lease, including all payments due. This substantial cost is in addition to the previously-mentioned expenses associated with the grounded aircraft.

If all this information is not sufficiently convincing, consider the supply and demand aspect of upgrading. As the deadlines draw ever near, the cost of components are increasing with demand. With a limited number of maintenance facilities capable of these installations, and the approximately 100 hours of work per aircraft it will take to complete them, the price for a slot also is likely to increase.

A reverse bell curve highlights the trend: while early buyers may have paid more for the new technology, late buyers will pay more for demand. Waiting will only increase your costs and inconvenience, whether you own the aircraft or not. The benefits of FANS1/A+ and ADS-B are clear. And failure to meet the upgrade deadlines is really not an option.

This article has been publish as it appeared in the January/February issue of Business Aviation Advisor