NAFA member, JetBrokers, shares their recent market update showing improving trends despite the COVID pandemic.

With the vaccine rolling out, JetBrokers forecasts 2021 will be a strong year for business aviation with ultra-high net individuals (UHNWIs) continuing to seek safer travel options to fulfill their personal travel needs in Q1. Corporate travel is expected to pick up again in Q2.

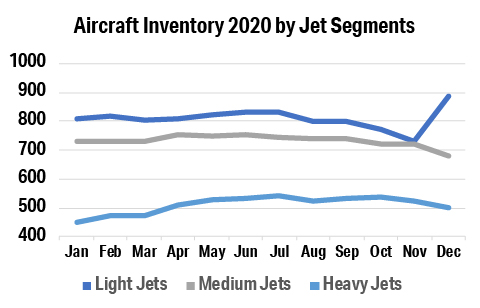

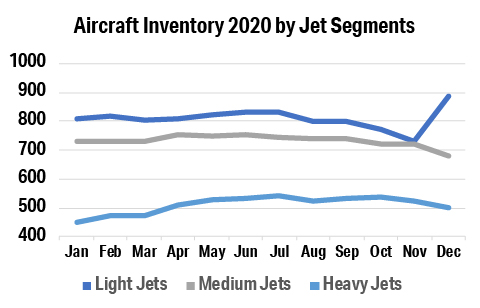

After increasing in 2019, overall inventories of preowned private jets and turboprops dropped in 2020, after increasing 2019. Inventories of light to medium jets are now below levels in January 2020. Inventories of heavy jets have increased.

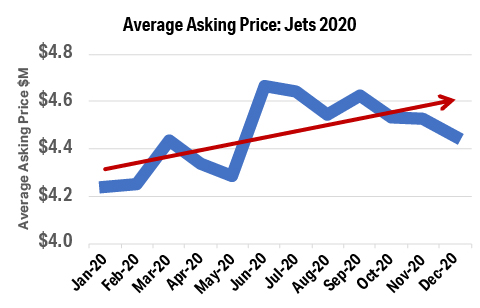

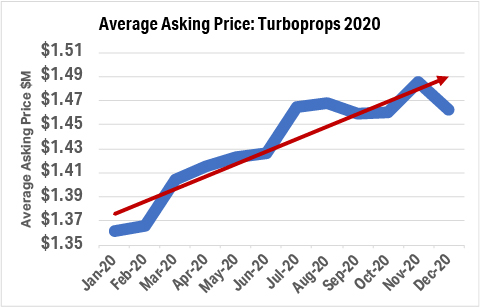

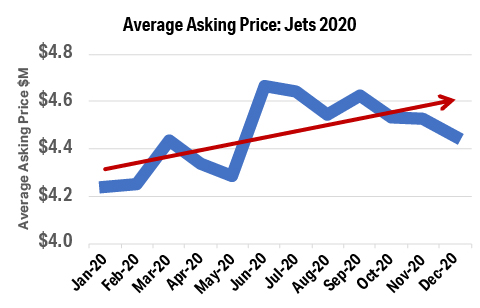

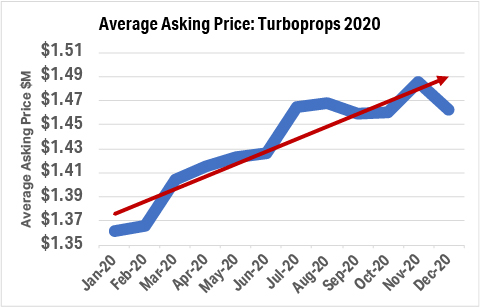

Average Asking Price Trends for Jets and Turboprops

After increasing in 2019, business aircraft sales prices dropped in 2020 while still remaining higher than 2018. The preowned jet and turboprop market will continue to improve as the vaccine continues to roll out. As ultra-high net worth individuals (UHNWIs) - who entered the market as first-time buyers in 2020 realize the value of business aviation - the market will continue to stabilize with steady growth projected for pre-owned transactions.

During the second half of 2020, aircraft prices for jet and turboprops trended upward despite the COVID pandemic. We expect demand for light to medium jets to remain steady and demand for heavy jets to return to previous rates in increase in 2021.

The BCI (Business confidence index) for the United States is higher than the world at large, despite the COVID pandemic, with increased confidence in near future business performance.

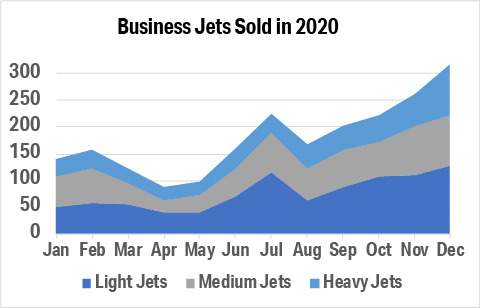

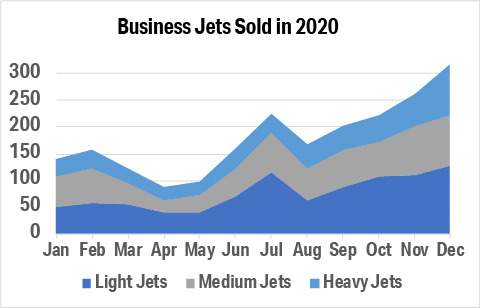

Pre-owned and new aircraft sales were on different trajectories in first three quarters of 2020. Sales volumes were down over the previous year with pre-owned transactions showing less impact than new aircraft deliveries. In contrast to their overall share of dollars, light jets continue to make up an important portion of the market in terms of aircraft delivered.

Forecast 2021 and Beyond

In 2021, new business aircraft models in development or close to release are AirBus ACJ TwoTwenty, Dassault Falcon 6X, Gulfstream G700, SyberJetSJ30i, Beechcraft King Air 360/360ER, Beechcraft King Air 260, Cessna Citation Hemisphere, Cessna Denali and Cessna SkyCourier.

Business aircraft asking prices are stabilizing with inventories either plateauing or falling. Demand for private jets and turboprops is expected to rise. The preowned market is improving with mostly robust demand indicators for business aircraft. Global aircraft market demand and usage varies depending on the overall needs of the region. Europe has pent up demand for light to medium jets while the Asian market has steady need for larger, long-range aircraft.

Industry forecasts for new business jet deliveries are valued between $217.5bn to $236bn for the next ten years with projections of between 6584 aircraft (per JETNET iQ) and 7404 aircraft (per Aviation Week).

Click here to download JetBrokers February 2021 Market Update PDF.

This report was originally published by JetBrokers in February 2021.