NAFA member, Aero Asset, has just released their HELI MARKET TRENDS Half Year 2023 Report - Twin Engine Edition.

Here are some Key Findings:

LESS DEALS, MORE SUPPLY FOR SALE

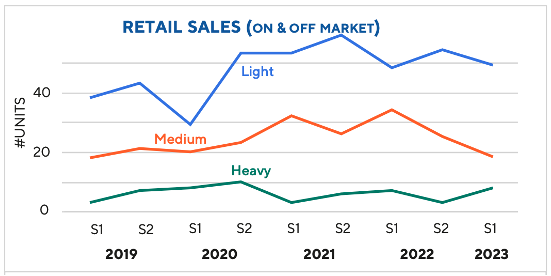

- Total retail sales decreased 15% 1st half of 2023 vs same period 2022 (YOY).

- Supply for sale was 18% higher year over year (YOY).

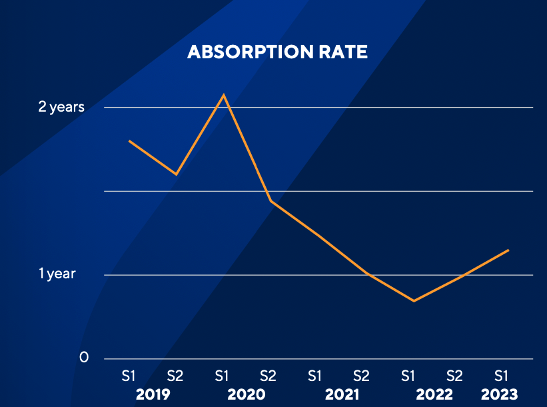

- Absorption rate increased to 14 months of supply at current trade levels.

WEIGHT CLASS PERFORMANCE

- Light & medium twin engine supply for sale increased 20% YOY.

- Medium twin engine retail sales volume decreased nearly 45% YOY.

- Light and Heavy retail sales remained stable over same period.

AVERAGE PREOWNED PRICES RESILIENT

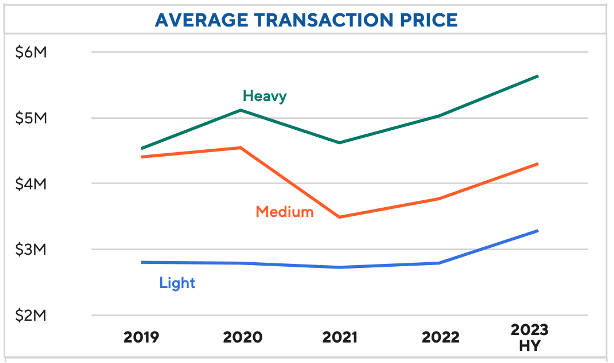

- Light twin average transaction price (“ATP”) stronger YOY, except in Bell 429 & EC/H145 markets.

- S76C+ / C++ ATP up $175k & 1.3m respectively, whilst other medium ATPs were either flat or down YOY.

- S92 ATP was stable YOY, whilst EC/H225 ATP +$1.1m YOY.

REGIONS

- Sales volume increased worldwide except in North America & Europe 1st half of the year vs. 2022.

- North America & Europe accounted for 75% of total transactions 1st half of 2023.

- Supply for sale increased twice as much in North America then Europe in the 1st half of the year.

- Supply for sale decreased 12% in Latin America 1st half of the year vs. 2022.

DEAL PIPELINE

- The number of deals pending at various stages of transaction increased 32% 2Q 23 vs. 2Q 22.

LIQUIDITY LINEUP

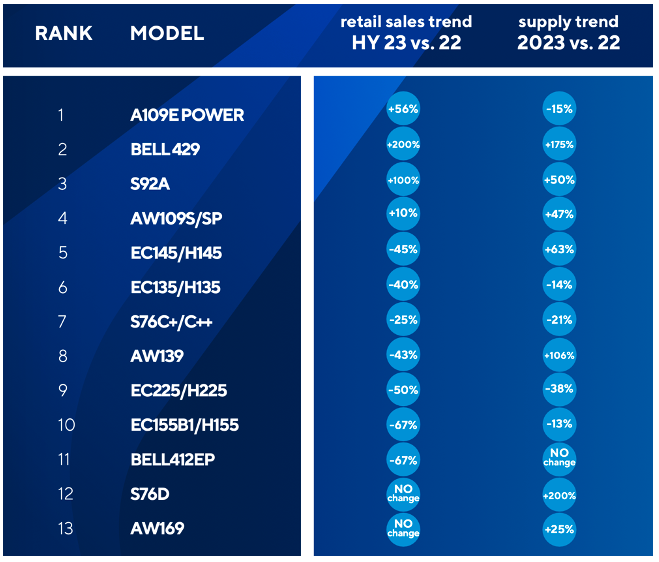

- The best performing preowned twin engine market in 1st half of 2023 was the Leonardo A109E Power, followed by the Bell 429 and the Sikorsky S92A.

- The AW169 is the only twin engine model with no retail sales over the 1st half of 2023.

Full Heli Market Trends report available here

This report was originally published by Aero Asset on September 21, 2023.