Activity

-

Tracey Cheek posted an articleAsset Backed Financing for Business Jets - What we can learn from Commercial Aviation see more

NAFA member Katerina Barilov with Shearwater Aero Capital writes about Asset Backed Financing and the lessons learned from commercial aviation.

Historically, the business jet industry was viewed by investors as exclusively a luxury marketplace. Personal aircraft were originally sold and used in the United States by wealthy business owners to facilitate trips across the vast expanses of the continent. Accordingly, the army of people who facilitated these sales became experts in evaluating wealth and calculating potential net worth of their clients. Until 2008, their approach generally proved to be the correct one – a customer’s ability to maintain, acquire and ultimately get financing for an aircraft was determined predominately by their creditworthiness.

However, the financial crisis brought with it more than just uncertainty about the frequency of aircraft sales or the prices at which they will clear; it revealed that the industry cannot survive as a luxury toy marketplace, - aircraft buyers of today are no longer exclusively high net worth individuals. Today’s buyers now include entrepreneurs launching new airline alternatives, African oil / mining companies, Southeast Asian charter / air ambulance operators, and governments in emerging markets seeking head of state aircraft.

Yet, the industry has not caught up to support this new type of buyer. Banks and finance companies still tend to evaluate deals based on creditworthiness and net worth of the customer, unsure of where the market for aircraft will be, and salespeople and brokers struggle to find ways to facilitate sales outside of a typical model.

To solve our ills, general aviation can turn to some lessons learned from our cousins in commercial aviation.

Shifting Away from the Credit-based Deal | The Benefits of Private Capital

For quite some time, the airline business has been increasingly challenging, with razor-thin margins and increasing competition. Airlines have gone in and out of bankruptcy and yet, access to financing has continued to exist.

This was accomplished by a major shift from credit to asset-based financing. Put simply, the bank uses not the customer’s bank statements and creditworthiness to secure the risk behind a transaction, but the ability to reclaim and re-sell the aircraft at a price where they can come out whole in case payments do not arrive. This requires not only the ability to predict depreciation rates but relationships with managers and brokers to quickly repossess and remarket the aircraft in the event of a Lessee default.

Many legacy banks and financing companies are still slaves to their compliance departments and investment committees which require clients to provide personal guarantees, or show proof of wealth, but there are specialty finance companies emerging which work with private capital sources and can move quickly on deals which typical banks would not consider. Hypothetically speaking, as long as the correct requirements are met, a customer can get financing without ever showing any financial info, and be in an airplane in as quickly as 4 weeks from the start of the application process.

Managing the Risk with Structure

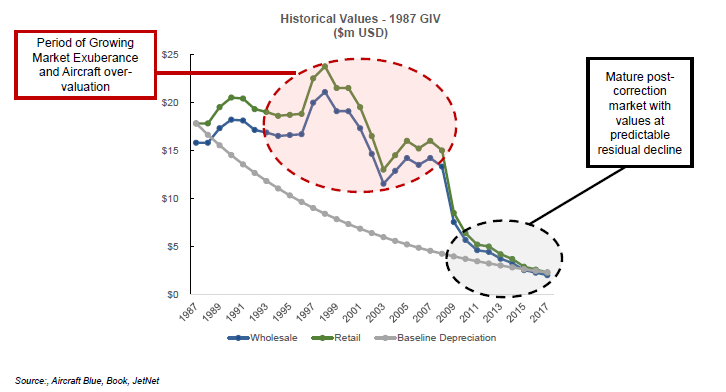

There is, of course, another difference between commercial and general aviation which gives financial institutions pause before investing in business jets – volatility in aircraft values. Prior to 2008, banks saw several aircraft appreciating in value year over year and perceived it as an easy way to get a large volume of loans on the books. A lack of discipline about depreciation rates, and bidding wars on transactions created an environment in which many banks and financing corporations found themselves in poorly structured loans with pricing which did not correctly match the risk.

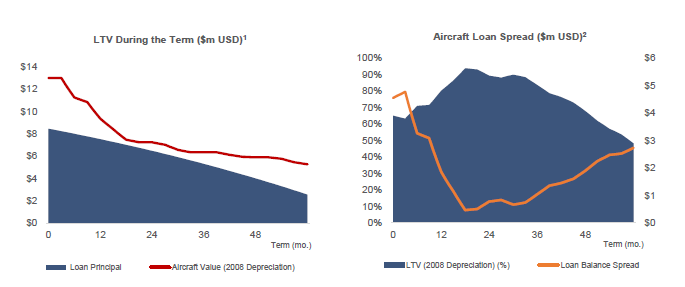

By maintaining a disciplined approach about low LTVs and realistic depreciation rates, financial investors would have been able to survive the 2008 crash. The below graph depicts a 65% advance, 5 year loan to a 30% balloon collateralized by a Bombardier Challenger 605 with actual historical depreciation rates witnessed in Q1 2008 and beyond. This structure would have left the financier above water throughout the crash.

While these terms hardly sound like they might be attractive, many of today’s jet buyers find themselves with a complete lack of options when it comes to financing alternatives, particularly in jurisdictions where cost of capital for loans on things like real estate or cars may be in double digits.

Luckily for the financier, business jets are not necessarily managed and operated by the same party seeking to purchase the aircraft and bear the loan, allowing for a choice of an appropriate partner, motivated to preserve asset value in case of repossession.

In deals like these, as long as a management company is approved by a lessor and the aircraft is registered in a friendly jurisdiction, almost any credit will do. This opens opportunities for financiers to be able to finance challenging credits, clients which do not have audited financial statements or disclosed personal wealth.

By taking the cues from the way the commercial aviation industry has headed, business jet financiers and brokers can open opportunities for more dealflow. While similar in some ways, these two very different industries are best suited when lessons learned are exchanged and implemented. In doing so, our industry evolves, and transactions which in the past were thrown out as impossible, may potentially become the future that carries us forward.

This article was written by Katerina Barilov of Shearwater Aero Capital and originally published in their aviation finance blog on April 23, 2018.

- Joe DiLallo likes this.