Asset Insight’s September 30, 2020 market analysis of 134 fixed-wing models, and 2,247 aircraft listed for sale, revealed the highest quarterly sales figure for the year while concurrently decreasing the tracked inventory fleet for a third consecutive month, this time by 1.5%.

Buyer preference for higher-quality assets decreased the tracked fleet’s Quality Rating while raising (worsening) Maintenance Exposure to a 12-month high (worst) figure. However, September’s fleet ‘for sale’ Quality Rating (5.293), though below August’s 5.329, equaled July’s figure, maintaining the tracked fleet’s ‘Excellent’ range YTD on a scale of -2.5 to 10.

September’s Aircraft Value Trends

The average Ask Price increased 1.5% in September to a figure approaching the 12-month high level, thereby lowering the year’s average pricing reduction to 1.6%. By aircraft group:

- Large Jets: The only group to post lower prices during September (1.5%) and Q3 (4.3%), Large Jets and are now down 13.5% for the year.

- Medium Jets: Ask Pricing increased 5.5% in September, 10.1% during Q3, and the group’s figure is up 4.4% in 2020.

- Small Jets: Pricing rose 2.2% in September, but recorded no change for Q3. Small Jet prices are up 8.8% YTD.

- Turboprops: Ask Prices rose 0.3% in September and 3.1% during Q3, but are still down 2.1% during 2020.

September’s Fleet for Sale Trends

Asset Insight’s tracked fleet’s total number of aircraft listed for sale decreased a further 1.5% in September (34 units), resulting in a YTD inventory increase of 3.0% (65 units).

- Large Jet Inventory: Increased yet again – this time by 2.2% (11 units) – and is now up 18.1% (78 units), YTD.

- Medium Jet Inventory: Availability decreased for the third consecutive month, down 1.4% (nine units) and inventory is now down YTD by 4.2% (28 units).

- Small Jet Inventory: Posted the largest decrease among the four groups for the second consecutive month. September’s decrease of 3.5% (23 units) contributes towards a 1.6% lower inventory for the year (10 units).

- Turboprop Inventory: Posting only its second monthly decrease since January, the group’s inventory fell 2.7% (13 units) thereby lowering its YTD increase to 5.6% (25 units).

September’s Maintenance Exposure Trends

Maintenance Exposure (an aircraft’s accumulated/embedded maintenance expense) worsened/increased 3.3% in September (6.4% during Q3), to $1.464m, a clear signal to buyers that upcoming maintenance expense for the now-available inventory mix will be higher. Maintenance Exposure worsened (increased) for all four groups in September.

- Large Jets: Worsened by 3.0% for the month for a total Q3 increase of 3.3%. That brings Maintenance Exposure above the 12-month average.

- Medium Jets: Worsened 1.2% during September, and rose 1.3% across Q3. Nevertheless the figure was better than the 12-month average.

- Small Jets: Increased 2.0% for the month while skyrocketing 14.6% during Q3 to a figure only marginally better than the group’s 12-month worst.

- Turboprops: The only group to post a Q3 improvement (3.0%), Turboprops nevertheless degraded during September by 1.3% to a figure marginally worse than August’s 12-month low (best) figure.

September’s ETP Ratio Trend

The tracked inventory’s ETP Ratio rose/worsened to 73.7%, from August’s 70.9%, to post a new record high figure. [The ETP Ratio calculates an aircraft's Maintenance Exposure as it relates to the Ask Price. This is achieved by dividing an aircraft's Maintenance Exposure (the financial liability accrued with respect to future scheduled maintenance events) by the aircraft's Ask Price.]

As the ETP Ratio decreases, the asset's value increases (in relation to the aircraft's price). ‘Days on Market’ analysis has shown that when the ETP Ratio is greater than 40%, a listed aircraft’s Days on the Market (DoM) increases, in many cases by more than 30%.

During Q3 2020, aircraft whose ETP Ratio was 40% or greater were listed for sale 50% longer than assets with an ETP Ratio below 40% (269 days versus 404 days). How did each group fare during September?

- Turboprops: For the tenth consecutive month, Turboprops posted the lowest (best) ETP Ratio, 41.6%, to achieve a new 12-month best (low) figure.

- Medium Jets: Fell in step with a 12-month low figure of their own, at 70.9%. However, that is likely to create few additional opportunities for most sellers.

- Large Jets: Set a record high (worst) figure, posting a Ratio of 74.1%.

- Small Jets: Nearly eclipsed their record worst Ratio of 101.7%, registering a 12-month high 100.3%.

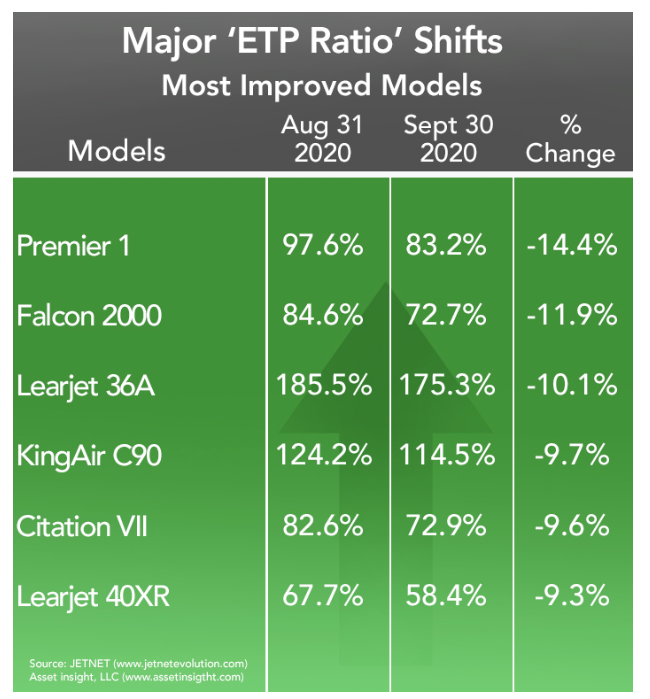

Excluding models whose ETP Ratio was over 200% during one of the previous two months (considered outliers), following is a breakdown of the business jet and turboprop models that fared the best and worst during September 2020.

Most Improved Models

All six ‘Most Improved’ models in September posted a Maintenance Exposure decrease (improvement). The Beechcraft Premier 1, Beechcraft King Air C90, and Cessna Citation VII posted Ask Price decreases of $15,629, $2,536, and $42,500, respectively, while the Bombardier Learjet 36A registered no Ask Price change.

The remaining two models experienced the following price increases:

- Dassault Falcon 2000: +$417,784

- Bombardier Learjet 40XR: +$125,833

Beechcraft Premier 1

Top position for September was captured by the Premier 1, which posted a Maintenance Exposure decrease approaching $185k that more than cancelled out the model’s Ask Price loss approaching $16k.

The inventory fleet mix saw one unit sell during September, one addition to the fleet, and one withdrawal from the ‘for sale’ pool. That left 20 assets listed ‘for sale’, or 16.8% of the active fleet.

With a very high percentage of these aircraft enrolled on an engine Hourly Cost Maintenance Program (HCMP), that tool is not a useful differentiator for sellers. With an ETP Ratio exceeding 83% little other than price is likely to capture a buyer’s attention.

Dassault Falcon 2000

One of only two aircraft on the Most Improved list to post an Ask Price increase in September, the Falcon 2000 took second place, having also achieved a Maintenance Exposure decrease $136k.

Two aircraft transacted in September, and when all of the jostling ended (including five additions to the inventory fleet), 27 aircraft were available to buyers. That equates to 12.1% of the active fleet and, keeping in mind the model’s 72.7% ETP Ratio, HCMP coverage may be the only value lever that some operators have to distinguish their asset.

Seller Advice: Those whose aircraft are not enrolled on an engine HCMP are advised to carefully consider all offers as this model sports engines with significant overhaul costs.

Bombardier Learjet 36A

A model that posted no transactions in September, along with no change in Ask Price, the Learjet 36A is next on the ‘Most Improved’ list, thanks to a Maintenance Exposure decrease approaching $81k.

However, with an ETP Ratio exceeding 175%, sellers of the four assets listed for sale must be open to all offers, even though the inventory level amounts to only 10.8% of the active fleet.

Beechcraft King Air C90

Four King Air C90s transacted during September, while another was withdrawn from the listed fleet. The 43-aircraft inventory that remained equated to 11.1% of the active fleet. The problem for sellers is tri-fold:

- First, the model’s ETP Ratio stands at 114.5% (well above the problematic 40% point).

- Second, few of these aircraft have engine HCMP coverage, limiting leverage as a discriminator.

- Third, while Maintenance Exposure decreased over $49k, Ask Prices also decreased.

Although this aircraft moved from August’s ‘Most Deteriorated’ list to September’s ‘Most Improved’, the facts do not really favor sellers. Buyers, on the other hand, have ample choice.

Cessna Citation VII

The single transaction in September, along with one withdrawal from inventory, allowed the remaining 19 aircraft listed for sale (16.7% of the active fleet) to join the ‘Most Improved’ list. Maintenance Exposure decreased nearly $156k, a figure that eclipsed an Ask Price decrease of $42.5k.

However, the model’s ETP Ratio of nearly 73% poses a significant challenge for sellers, except, perhaps, for some whose aircraft are enrolled on engine HCMP.

Bombardier Learjet 40XR

The final aircraft on the ‘Most Improved’ list occupied the ‘Most Deteriorated’ list in August. A Maintenance Exposure decrease approaching $94k, and an Ask Price increase approaching $126k were what made this possible.

No Learjet 40XRs transacted in September, and the 13 inventory assets represent 14.1% of the active fleet. While availability exceeding 10% generally favors buyers, the model’s ETP Ratio, at 58.4%, can be favorably and sufficiently adjusted by engine HCMP coverage to help many sellers.

Read the full report here.

This report was originally published by AvBuyer on October 14, 2020.