NAFA member, Brian Proctor, CEO of Mente Group, discusses the benefits of charter.

There have been numerous articles exploring the benefits of charter.

There have been innumerable cases of management companies telling owners and potential owners that they will “make money” owning and chartering a jet.

In this article we will review a client case where we studied the true marginal return of chartering, explore the “make money” assertion, and analyze the situations when operating Part 135, in a charter environment truly makes sense.

The Client Case: To Charter or Not to Charter

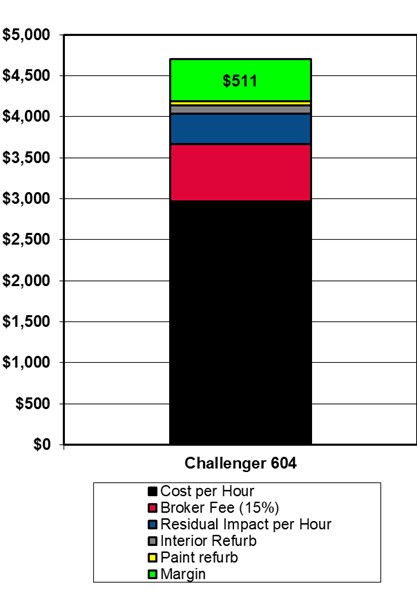

Recently, we were approached by a long-time client who owns a Challenger 604. The client was approached out of the blue by an aggressive management operation, offering to manage the client’s aircraft, put it on a Part 135 certificate and to hold it out to third-party users of the aircraft. The manager provided a very detailed operating proforma showing the “profits” that the client would make, along with a slick brochure indicating that the aircraft would “pay for itself”.

We recommended to the client that we perform a true “Margin Analysis” based on a per-hour return. In the analysis, we assumed three-hundred charter hours per year. We factored in the Charter Revenue and Fuel Surcharge, along with the Direct Operating Costs and brokerage Fees for the aircraft. In addition, we factored in non-cash costs associated with each hour of flying, including:

- Blue Book based residual value charge per hour

- Wear and Tear to the Paint allocated per charter hour

- Wear and Tear to the Interior allocated per charter hour

As part of the analysis, we did not factor in any costs relative to fixed maintenance for the aircraft, including the 96 Month Inspection, lesser inspections, gear overhaul, etc.

As a net result, the client would receive Five-Hundred Eleven ($511) Dollars per hour of net charter margin, or $153,300 on an annual basis. When compared to the owner’s fixed cost of operations, approximately $600,000 annually, the charter margin offset approximately one-quarter of the fixed costs. When factoring capital (or a better analysis of residual value loss), chartering does not come close to “making money”

“Making Money”

As you can imagine, Mente Group is often asked to study charter as a way to “have the aircraft pay for itself”. We’ve run hundreds of scenarios. Most typically, we will be asked to review 150-250 hours of owner usage, augmented with 100-200 hours of third-party charter. The findings generally point to the same conclusion. Under most usage patterns, we’ve found that, at best, chartering your aircraft helps to offset the fixed cost burden of the aircraft.

So, you’re probably asking, “at what point does charter pay for the plane?” We’ve done the analysis. But, before we go to the answer, you must remember that as utilization increases, pilot staffing needs to increase as well. So, based on the findings, a 4.5 pilot organization, flying 100 owner hours a year and 700-750 hours of charter comes close to covering the owner’s usage and covering the fixed costs. (it still won’t cover the major fixed maintenance inspections.) Not until you approach 1000-1200 hours of charter alone (depending on aircraft type) do you approach break even. To approach this level of utilization, along with the increased crewing requirements, your airplane must ‘float’ becoming nomadic without a traditional home base or hangar. Additionally, your aircraft becomes part of the wholesale market, with a client base focused on the lowest price, not the best aircraft. Clearly, it is very difficult under normal operations to ever make money chartering an aircraft.

When Chartering Makes Sense

As we’ve worked with clients all over the US, we’ve come across several situations where chartering does make sense:

- Sales/Use Tax Mitigation: There are several US states that waive sales / use tax on aircraft used primarily in commercial operations. Some of the states call this a “Rolling Stock Exemption”. In this case, the owner is advised to work closely with aviation tax counsel to structure an operating model that not only exceeds the requirements, but also has appropriate record keeping systems in place to defend against almost certain audit.

- Property Tax Mitigation: Like sales tax, certain property taxing authorities around the country waive or significantly reduce property tax on aircraft used in commercial operations. Taxing authorities vary greatly on this, and the analysis needs to be conducted at the state, county and even the city level.

- Related Party Usage and Reimbursement: In a situation where an owner wants to allow a related party (friends, colleagues, a business, etc.) use of an aircraft and get reimbursed, operating Part 135 and chartering the aircraft to them is an easy way to achieve the desired results. This avoids the pitfalls of unintentional illegal charter –a hot issue today with the regulatory authorities

- Optics: Often times, client companies will charter their aircraft to improve the optics of ownership by having the aircraft “making money” when the corporation isn’t using it.

- Liability: This ties back to an FAA concept of “Operational Control”. When a Part 135 Operator is operating your aircraft, operational control of the aircraft shifts from the owner to the operator. Theoretically, this then shifts liability in case of an accident or incident to the operator.

- Fixed Cost Offset: As mentioned above, chartering allows an owner to reduce the fixed cost of ownership, but rarely eliminates them.

Obviously, the decision to hold-out your aircraft for charter is a complex decision. In many ways, it can simplify operations and reduce the cost of ownership, but there’s no way to eliminate it. Much like renting out your vacation home, once you make the purchase decision, you can consider whether you want to rent it out to offset some of your costs. But it won’t pay for the asset – including capital and operating expenses – much less make money. Otherwise, we’d all own money-making charter airplanes as part of our investment portfolio. And we don’t. Feel free to reach out to the team at Mente and we can help you explore this topic in greater detail.

This article was originally published by Mente Group on October 30, 2020.